On January 1, 2024, the Corporate Transparency Act (CTA) became effective. This sweeping new law imposes significant reporting obligations upon many types of legal entities, which are now required to report beneficial ownership and registrant information to the U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN).

Specifically, unless a reporting exemption applies, the CTA requires any corporation, limited liability company or other entity created by the filing of a document with a secretary of state or any similar office under the law of a state or Indian tribe (a “Reporting Company”) to disclose beneficial ownership information (BOI) about those natural persons who, directly or indirectly:

- Exercise “substantial control” over such Reporting Company; or

- Own or control at least 25% of the “ownership interests” of such Reporting Company.

An individual who meets at least one of the above criteria, unless an exception exists, is deemed to be a beneficial owner (“Beneficial Owner”) of the Reporting Company. A Reporting Company is obligated to report to FinCEN the BOI of each and every one of its Beneficial Owners, and the CTA imposes substantial penalties for reporting violations. Note that the CTA requires Reporting Companies to identify individuals who meet the definition of Beneficial Owner; entities are not Beneficial Owners even if they are members or owners of Reporting Companies. When an entity, rather than an individual, owns 25% or more of the ownership interests of a Reporting Company, the Reporting Company should not report the corporate entity; instead, it should report the individual or individuals who are the direct or indirect Beneficial Owners of the entity. The only exception is when the 25% Beneficial Owner is itself an entity exempt from CTA reporting, in which case the Reporting Company can report the exempt entity as a Beneficial Owner.[1]

This is the third in a series of articles examining the above two categories of beneficial owners. Here, we focus on the second criteria for Beneficial Owners—i.e., those who own or control at least 25% of the ownership interests of a Reporting Company and how the CTA defines ownership interests.

Read Part I and Part II of this series relating to beneficial ownership and substantial control.

How Are “Ownership Interests” Defined?

In order to determine whether an individual is a Beneficial Owner, we first need to know how the CTA defines “ownership interests” in an entity. The regulations implementing Beneficial Ownership reporting under the CTA[2] provide that “ownership interest” means:

(A) Any equity, stock, or similar instrument; preorganization certificate or subscription; or transferable share of, or voting trust certificate or certificate of deposit for, an equity security, interest in a joint venture, or certificate of interest in a business trust (regardless of whether the instrument is transferable, is classified as stock or anything similar, or confers voting power or voting rights);

(B) Any capital or profit interest;

(C) Any instrument convertible into any share or instrument described in (A) or (B), any future on any such instrument, or any warrant or right to purchase, sell, or subscribe to a share or interest described in (A) or (B), regardless of whether characterized as debt;

(D) Any put, call, straddle, or other option or privilege of buying or selling any of the items described in (A), (B), or (C) without being bound to do so, except to the extent that such option or privilege is created and held by a third party or third parties without the knowledge or involvement of the reporting company; or

(E) Any other instrument, contract, arrangement, understanding, relationship, or mechanism used to establish ownership.[3]

Ownership interests, then, are not limited to traditional shares of stock or partnership interests.

An individual may directly or indirectly control an ownership interest through a contract or other relationship, including (i) joint ownership with one or more other persons of an undivided interest through another individual acting as a nominee, intermediary, custodian; (ii) as an agent on behalf of such individual or through ownership or control of intermediary entities; or (iii) a trust or similar arrangement that holds such ownership interest.[4]

If an individual owns 25% or more of the ownership interests (as broadly defined above) in an entity, then the Reporting Company will need to report that individual’s BOI. However, certain holders of ownership interests are not considered Beneficial Owners under the CTA, including:

- A minor child (although the personal information of a parent or guardian has to be reported);

- A nominee, intermediary, custodian, or agent of another individual;

- An employee acting solely as an employee;

- An individual whose only interest in a reporting company is a future interest through a right of inheritance; and

- A creditor of the reporting company.

For those Reporting Companies that have a simple ownership structure, such as two individual owners who own 50% of the company’s ownership interests, it will be straightforward when determining the Beneficial Owners based solely on ownership percentages. However, for those Reporting Companies with a more complex ownership structure, the question of who owns 25% or more of the company’s ownership interests, and therefore who qualifies as a Beneficial Owner based on ownership, may be less clear.

The Calculation Rule

To assist Reporting Companies in determining which of its owners would be a Beneficial Owner, the CTA has provided a rule to follow called the calculation rule. The calculation rule provides the following methods to help determine whether an individual owns or controls at least 25% of the ownership interests of a Reporting Company, directly or indirectly:[5]

- First, calculations are to be made “at the present time, and any options or similar interests of the individual shall be treated as exercised.”

- Partnerships: For Reporting Companies that issue capital or profit interests (including entities treated as partnerships for federal income tax purposes), the individual’s ownership interests are the individual’s capital and profit interests in the entity, calculated as a percentage of the total outstanding capital and profit interests of the entity.

- Corporations: For corporations, the applicable ownership percentage shall be the greater of:

- The total combined voting power of all classes of ownership interests of the individual as a percentage of total outstanding voting power of all classes of ownership interests entitled to vote; or

- The total combined value of the ownership interests of the individual as a percentage of the total outstanding value of all classes of ownership interests.

- Default if Uncertainty: If the facts and circumstances do not permit the calculations described in either paragraph above to be performed with reasonable certainty, any individual who owns or controls 25% or more of any class or type of ownership interest of a Reporting Company shall be deemed to own or control 25% or more of the ownership interests of the Reporting Company.

Generally, for corporations, the calculation of an individual’s ownership interest is a percentage of the total shares of stock issued. However, if certain shares have more voting power or represent more of the value of the Reporting Company than other shares (for example, if the Reporting Company issues both series A shares with one vote per share and series B shares with five votes per share), then two separate calculations are needed for each series of stock, and the individual’s ownership interest will be the larger of the two percentages.

Ownership Structure Examples

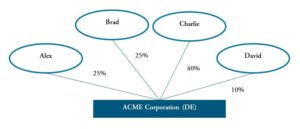

Simple Ownership Structure – Corporation

Assuming there are no other relevant facts, and that Acme Corporation has only one class of shares, the Beneficial Owners for the Acme would be Alex, Brad, Charlie as they each own 25% or more of the ownership interests in ACME Corporation.

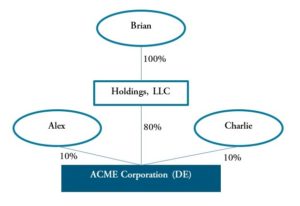

Indirect Ownership Structure – Corporation

Assuming there are no other relevant facts, and that Acme Corporation has only one class of shares, Brian would be the only Beneficial Owner of Acme in this example. Alex and Charlie each fall below the 25% threshold. Brian owns 100% of Holdings, LLC and has an indirect beneficial ownership of 80% of ACME Corporation and qualifies as a Beneficial Owner under the ownership test.

These are relatively simple examples for corporations. Determining beneficial ownership will be more difficult with greater numbers of shareholders and multiple classes of shares.

Complex Ownership Structure – Corporation (Multiple Share Classes)

Let’s return to our first scenario, but instead assume that David’s 10% interest is comprised of a class of preferred shares that vote on a 1 vote per share basis with the common shares. In addition, David also acquired a warrant to purchase 2 additional common shares for each preferred share.

The calculation rule requires Acme Corporation to treat David as having exercised the warrant. As a result, David is a Beneficial Owner holding a 25% interest (30/120). Charlie remains a Beneficial Owner with a 33.3% interest (40/120) on a fully diluted basis, while Alex and Brad each owns a 20.8% interest (25/120) on a fully diluted basis and no longer qualify as “Beneficial Owners” solely on the basis of their individual share ownership.

Let’s change the facts further and assume the number of shares for which David’s warrant can be exercised varies, depending upon Acme Corporation’s future earnings. Under the calculation rule, facts and circumstances do not permit the impact of the exercise of David’s warrant to be calculated with certainty. As a result, Alex, Brad and Charlie are Beneficial Owners because each owns 25% or more of the common shares. However, because David owns 100% of a different class of shares, David is also a Beneficial Owner.

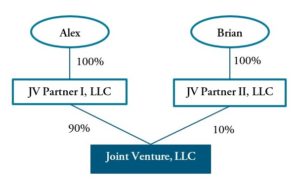

Assuming there are no other relevant facts, and that Joint Venture, LLC has only one class of units, Alex would be the only Beneficial Owner of Joint Venture in this example. Brian does not meet the 25% threshold since JV Partner II, LLC only owns 10% of Joint Venture. Alex owns 100% of JV Partner I, LLC and has an indirect beneficial ownership of 90% of Joint Venture and qualifies as a Beneficial Owner under the ownership test.

Now, let’s assume all the facts are the same except now the JV Partners have entered into a Joint Venture Agreement to govern the operations of Joint Venture, LLC. The JV Agreement includes a distribution waterfall which states that the future profits of the Joint Venture are to be distributed 50% to JV Partner I and 50% JV Partner II. In this scenario, both Alex and Brian would each have a 50% interest in the future profits of the Joint Venture. This interest meets the 25% threshold therefore both Alex and Brian would be Beneficial Owners of Joint Venture, LLC.

Wholly Owned Subsidiary Exemption

There are certain exemptions that should be considered when determining whether an entity must report BOI. A subsidiary whose ownership interests are wholly owned and controlled by certain exempt entities, such as an SEC reporting company, a bank or a tax-exempt entity, is exempt from the BOI reporting requirements. In this context, control of ownership interests means that an exempt entity entirely controls all of the ownership interests in the reporting company.[6]

However, three classes of “exempt” reporting companies cannot pass along an exemption via the subsidiary exemption. This includes money service businesses, pooled investment vehicles and “entities operating exclusively to provide financial assistance to, or hold governance rights over, tax-exempt entities.”

A subsidiary whose ownership interests are only partially controlled by an exempt entity will not qualify for the exemption. The subsidiary’s ownership must be fully 100% owned or controlled by an exempt entity.[7]

Conclusion

As we noted in prior articles, Reporting Companies must now file BOI reports with FinCEN regarding entities formed on or after January 1, 2024. By January 1, 2025, Reporting Companies will have to file BOI reports on entities created prior to January 1, 2024. Reporting Companies will also be obligated to submit updated reports to FinCEN if BOI information changes over time.

In order to meet their reporting obligations, Reporting Companies will need to determine who qualifies as a Beneficial Owner of the company based on ownership interests and obtain the BOI of all potential Beneficial Owners. Please contact the authors of this article, or any member of Frost Brown Todd’s Corporate Transparency Act Team, for guidance on your reporting obligations.

[1] 31 C.F.R. § 1010.380(b)(2)(i)

[2] 31 C.F.R. § 1010.380 31 C.F.R. § 1010.380(b)(2)(i).

[3] 31 C.F.R. § 1010.380(d)(2)(i)(A)-(E)

[4] 31 CFR 1010.380(d)(2)(ii)

[5] 31 CFR 1010.380(d)(2)(iii)

[6] 31 CFR 1010.380(c)(2)(xxii)

[7] Beneficial Ownership Information Reporting, Frequently Asked Questions, L. 6, Issued Jan. 12, 2024