*James Hardman contributed to this article while working as a summer associate at FBT. James is not a licensed attorney.

On May 31, 2023, the Internal Revenue Service (IRS), along with the Treasury Department, issued proposed regulations regarding the eligibility of solar- and wind-powered electricity generation facilities situated within or linked to low-income communities to participate in the Low-Income Communities Bonus Energy Investment Credit Program (the “Bonus Program”).[1] The Bonus Program, established by the Inflation Reduction Act of 2022 and formally documented in the Internal Revenue Code Section 48(e), provides for an additional 10 or 20 percentage points added to the amount of investment tax credits, or ITCs, available for certain qualifying projects. These proposed rules update and define key terms originally described in IRS Notice 2023-17, published in February 2023 (a summary of which is covered in our previous article found here).

Key Takeaways

Developers and investors of qualifying renewable energy property eyeing opportunities in targeted low-income communities will find some clarity, as the proposed rules define key concepts and streamline the allocation process for the Bonus Program. The proposed rules:

- Define priority selection criteria based on ownership and geographic location;

- Detail the specific documentation and attestation requirements for application and proof of placement in service of the qualified renewable energy property; and

- Outline the new disqualification and recapture rules that could lose an applicant their eligibility under the scheme and permit the government to recover the tax credit.

General Program Requirements

Facilities generating electricity from wind, solar, or small wind energy properties with a maximum net output of less than 5 megawatts (MW) of alternating current (AC) fall under four specific categories and may be eligible for an allocation through the Bonus Program. Notably, Category 3 and 4 facilities are eligible for a higher credit amount increase of 20 percentage points compared to the standard 10 percentage points. The total annual Capacity Limitation of 1.8 gigawatts is allocated for 2023 as follows:

- Category 1: low-income community facilities (700 MW);[2]

- Category 2: facilities on Indian land (200 MW);

- Category 3: qualified low-income residential building projects (200 MW); and

- Category 4: qualified low-income economic benefit projects (700 MW).

Facilities granted a bonus credit allocation must be placed in service within four years. As noted in previous guidance, qualified facilities that are placed in service before receiving an allocation of Capacity Limitation will not be eligible to receive such allocation.

The Capacity Limitation allocations involve an initial application window, followed by a rolling application process. Priority for allocation under each category is determined on a sliding scale based on the applicant facility’s satisfaction of “Additional Selection Criteria” (related to ownership[3] and geographic[4] characteristics). Facilities that satisfy both the ownership and the geographic factors—for example, a facility that is both owned by a qualified tax-exempt entity and located in a “disadvantaged” census tract—receive the highest priority, followed by those applications that satisfy only one of the additional selection criteria. If there are too many similarly situated applications under a specific category, then a lottery system will be used to decide between them. Applicants will not be able to administratively appeal the Capacity Limitation allocation decisions.

Key Definitions

- Qualified facilities include any facility that generates electricity solely from a wind facility, solar energy property, or small wind energy property that has a maximum net output of less than 5 MW, and meets the Category 1, 2, 3, or 4 criteria.[5]

- Note: Multiple solar or wind energy properties or facilities that are operated as part of a single project are aggregated and treated as a single facility, depending on the facts and circumstances.[6]

- Energy storage technology may be considered part of a qualified facility if it is installed in connection with the facility and meets certain criteria—such as common ownership, co-location, a common interconnection point, description in at least one common environmental or regulatory permit—and the energy storage technology is charged at least 50% by the other property in the qualified facility.[7]

- Financial benefits: In order for a facility to be considered part of a qualified low-income residential building project, the financial benefits of the electricity produced by the facility must be allocated equitably among the occupants of the residential rental building that participates in a covered/affordable housing program.[8] At least 50% of the financial value of net energy savings is required to be equitably passed on to the building occupants by either equal distribution among low-income households within the covered housing program or proportionate distribution based on each dwelling unit’s electricity usage.

- Note: The proposed rules provide different methods of calculating the value of net energy savings as well as other requirements for participation depending on whether the facility and the residential property have common[9] or separate[10] ownership or whether the residential building is master-metered[11] or sub-metered.[12]

- Low-income households: To meet qualification criteria, the facility must serve multiple households, with a minimum requirement of distributing at least 50% of its total output to qualifying low-income households. Applicants will be prioritized if they offer a bill credit discount rate of at least 20% for all low-income households.[13] The applicant must verify the households’ qualifying low-income status.[14]

- Location: A qualified facility is in a geographically qualifying area if it is located in a low-income community, on Indian land, in a geographical area under the Additional Selection Criteria, and it satisfies the “Nameplate Capacity Test.”

- Note: This requires 50% of the facility’s energy-generating capacity to be in the qualifying area to determine eligibility.

Application Materials

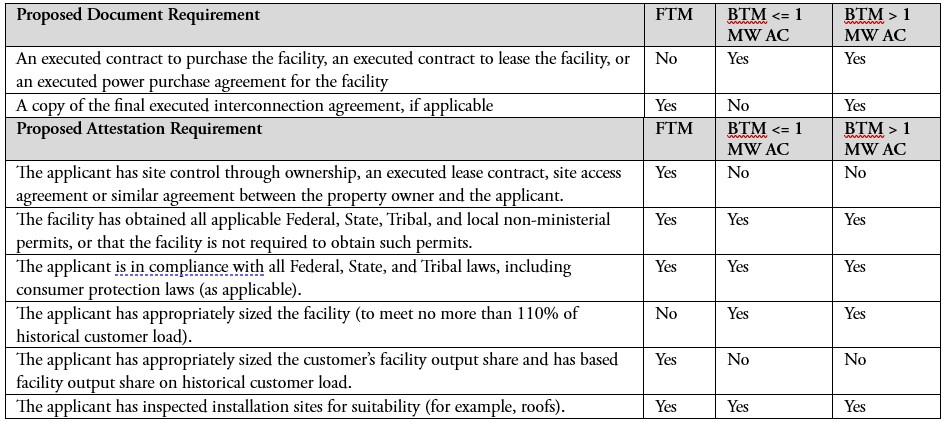

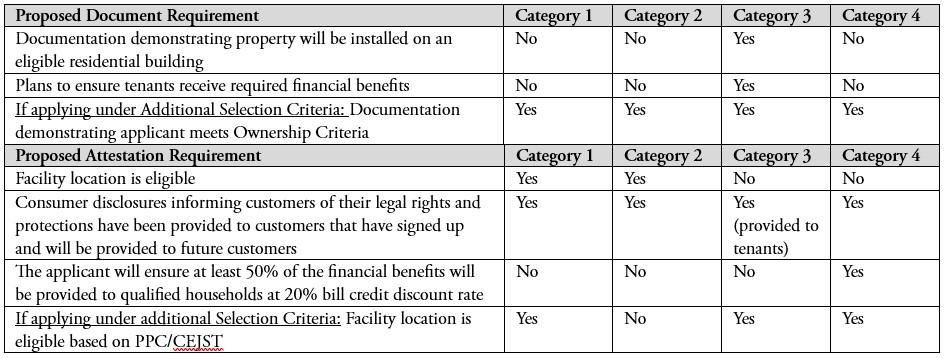

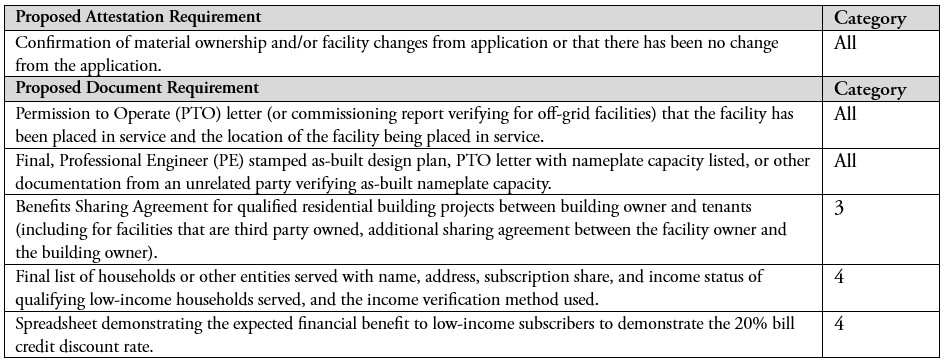

To ensure the viability of facilities receiving a bonus credit, the IRS and the Treasury Department have established requirements for the documentation and attestations to be presented upon application, when the facilities are placed in service, and to comply post-allocation. The summary tables published in the guidance are reproduced below.

- Documentation and Attestations to Be Submitted for All Facilities

- Documentation and Attestations to Be Submitted for Certain Facilities Depending on Category and Additional Selection Criteria

- Documentation and Attestations Demonstrating the Facility Has Been Placed in Service Within Four Years of the Allocation

Disqualification and Recapture

As noted in the proposed regulations, a qualified facility that has been granted a Capacity Limitation allocation may lose its eligibility for the allocation if it no longer meets the requirements prior to or upon being placed in service.[15] Moreover, an applicant’s increased 48(e) benefit may be subject to recapture if (i) the property ceases to be eligible for the increased credit because it no longer meets the financial benefit distribution requirements, (ii) the residential rental building the facility is part of ceases to participate in a covered housing program, or (iii) the facility increases its output above the 5 MW threshold.[16] Upon discovering that their 48(e) benefit is subject to recapture, an applicant has 12 months to restore its eligibility. However, it is important to note that this restoration is not available more than once with respect to any facility.

Timeline for Comments

The deadline for submitting comments on the proposed regulations is June 30, 2023. The IRS and Treasury Department specifically seeks input on whether these proposed rules should also be applicable to 2024 allocations and whether the program should be established under section 48E(h) for 2025 and subsequent years.

For more information regarding the proposed regulations or how the Inflation Reduction Act could impact your business, please contact the authors of this article or any member of Frost Brown Todd’s Tax practice group.

[1] Additional Guidance on Low-Income Communities Bonus Credit Program (REG-110412-23), 88 F.R. 35791 (June 1, 2023), https://www.federalregister.gov/documents/2023/06/01/2023-11718/additional-guidance-on-low-income-communities-bonus-credit-program.

[2] Under the proposed rules, the 700 MW allocation for Category 1 facilities will be sub-divided between eligible residential behind-the-meter (BTM) facilities and applicants with front-of-the-meter (FTM) facilities, as well as non-residential BTM facilities.

[3] The applicant-owner of the qualified facility meets the ownership criteria if it is owned by a Tribal Enterprise, and Alaska Native Corporation, a renewable energy cooperative, a qualified renewable energy company meeting certain characteristics, or a qualified tax-exempt entity (including corporations described under sections 501(c)(3), (c)(12) and section 501(d), a State, political subdivision thereof, territory or any agency or instrumentality thereof, an Indian Tribal government, or a corporation described under section 501(c)(12).

[4] To meet the geographic criteria, the facility must be located in a Persistent Poverty County (PPC, based on the definition used by the U.S. Department of Agriculture) or in a census tract that is designated in the Climate and Economic Justice Screening Tool (CEJST) as “disadvantaged” based on whether the tract is either (a) greater than or equal to the 90th percentile for energy burden and is greater than or equal to the 65th percentile for low income, or (b) greater than or equal to the 90th percentile for PM2.5 exposure and is greater than or equal to the 65th percentile for low income.

[5] As described in section 48(e)(2)(A)(iii). Please see our previous note on the Low-Income Communities Bonus Credit Program for further details on these categories.

[6] Evaluated based on the factors provided in section 7.01(20(a) of Notice 2018-59 or section 4.04(2) of Notice 2013-29, as applicable.

[7] Under a proposed safe harbor, the energy storage technology is deemed to be charged at least 50% by the facility if the power rating of the energy storage technology is less than 2 times the capacity rating of the connected wind facility (in kW AC) or solar facility (in kW DC).

[8] As defined in § 41411(a) of the Violence Against Women Act of 1994 (34 U.S.C. 12491(a)(3)), a housing assistance program administered by the Department of Agriculture under title V of the Housing Act of 1949, a housing program administered by a tribally designated housing entity (as defined in § 4(22) of the Native American Housing Assistance and Self-Determination Act of 1996 (25 U.S.C. 4103(22)), or such other affordable housing programs as the Secretary may provide.

[9] Net energy savings when there is common ownership of the facility and the residential property are defined as the financial value equal to the greater of (1) 25% of the gross financial value of the annual energy produced; or (2) the gross financial value of the annual energy produced minus the annual costs to operate the facility. If the facility and building are commonly owned, a signed benefits sharing agreement between the owner and tenants is required.

[10] Net energy savings when there is separate ownership of the facility and the residential property are defined as equal to the greater of (1) 50% of the financial value of the annual energy produce by the facility which accrues to the owner of the qualified residential property in the form of utility bill credit and/or cash payments for net excess generation; or (2) the financial value of the annual energy produced by the facility which accrues to the owner of the qualified residential property in the form of utility bill credit and/or cash payments for net excess generation minus any payments made by the building owner to the facility owner for energy services associated with the facility in a given year. The facility owner must enter into an agreement with the building owner for the latter to distribute the savings to residents.

[11] For master-metered buildings, the building owner must pass on the savings through other means. Applicants should follow guidance issued by the U.S. Department of Housing and Urban Development.

[12] For sub-metered buildings, the tenants must receive the financial value associated with utility bill savings in the form of a credit on their utility bills.

[13] A bill credit discount rate is defined as the difference between the financial benefit distributed to the low-income household and the cost of participating in the program, expressed as a percentage of the financial benefit distributed to the low-income household.

[14] Applicants may use categorical eligibility, such as a household’s participation in a needs-based Federal, State, Tribal, or utility program, or other income verification methods such as paystubs, tax returns, or information from credit agencies and commercial data sources. Self-attestations are not permissible.

[15] This may occur if (1) the facility’s location changes; (2) the name plate capacity increases in excess of the <5MW AC output limitation or decreases by the greater of 2 kW or 25% of the Capacity Limitation awarded in the allocation; (3) the facility cannot satisfy the financial benefits requirements as planned; (4) the eligible property is not placed in service within four years after the date the applicant was notified of the allocation of Capacity Limitation to the facility; (5) the facility no longer meets the ownership criteria, unless exceptions apply.

[16] Specifically, the following circumstances result in a recapture event if the property ceases to be eligible for the increased credit under section 48(e): (1) the qualifying property fails to provide financial benefits over the 5-year period after its original placed-in-service date; (2) the qualifying property ceases to allocate the financial benefits equitably among the occupants of the dwelling units; (3) the qualifying property ceases to provide at least 50 percent of the financial benefits of the electricity produced to qualifying households or fails to provide those households the required minimum 20 percent bill credit discount rate; (4) the residential rental building the facility is a part of ceases to participate in a covered housing program, if applicable; and (5) a facility increases its output to more than 5 MW AC, unless the applicant can prove that the output increase is not attributable to the original facility but rather is output associated with a new facility under the 80/20 Rule (the cost of the new property plus the value of the used property).