The Inflation Reduction Act of 2022 (the “IRA” or “Act”) presents an opportunity to significantly offset the cost of constructing renewable energy generation facilities and other green-energy projects. Specifically, the Act amended the Internal Revenue Code (IRC) to incentivize clean energy technologies in three ways: (1) by extending already existing energy tax credits while establishing a two-tiered credit structure; (2) creating a host of new tax credits; and (3) monetizing the tax credits. Now, with the potential bonus tax credits available, the Act can take investment tax credits on certain projects as high as 70% of the qualified investment.

Taken together, these tax credits and incentives represent potential cost savings of an order of magnitude not seen in the energy sector for decades. Still, the tax structure and requirements are nuanced and warrant appropriate due diligence to determine if a project is eligible to receive one or more tax credits. To assist with this, our team has broken down the Act’s key features that are specifically targeted to the energy industry.

Expansion of the Existing Energy Tax Credits

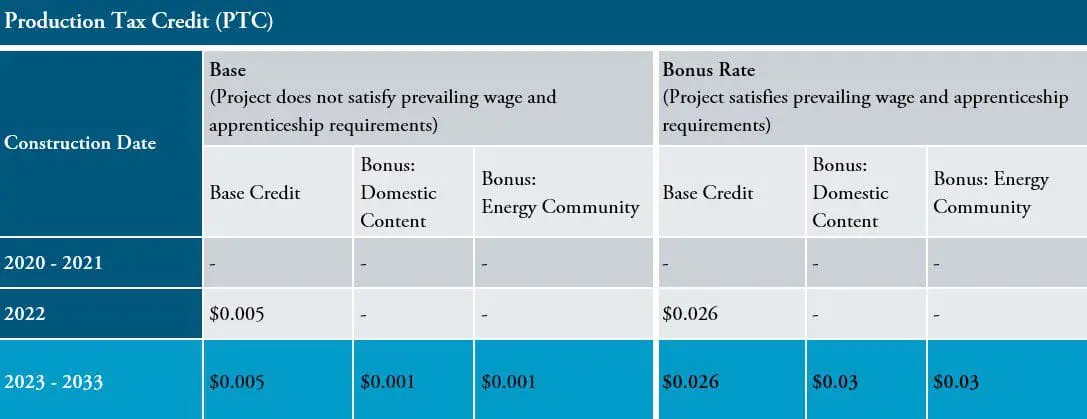

Prior to the Act, the inflation-adjusted IRC Section 45 Production Tax Credit (PTC) (currently 2.6 cents per kWh) was available to electricity produced at qualified wind, biomass, geothermal, landfill gas, and hydropower facilities. Under the IRA, solar facilities are once again eligible for this energy tax credit, and wind facilities that begin construction by the end of 2024 are now eligible for the PTC.

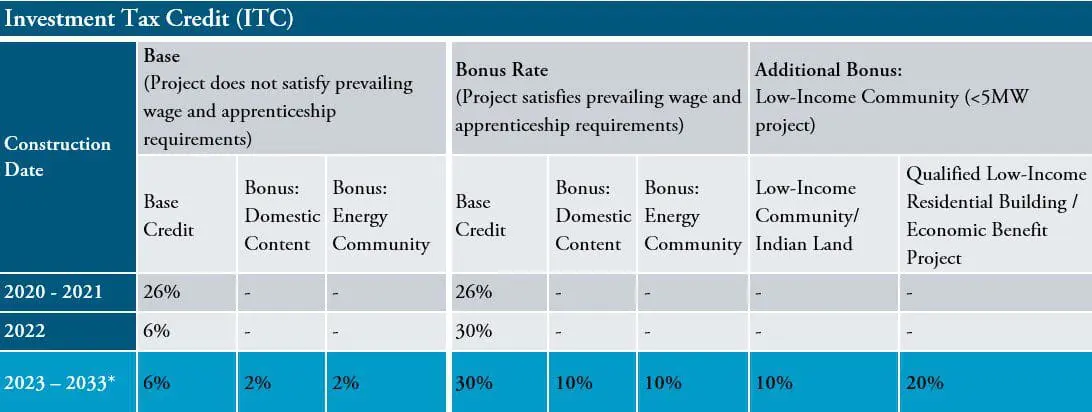

The Act also expands the applicability of the IRC Section 48 Investment Tax Credit (ITC), which is now equal to a base credit rate of 6% of the qualified costs of eligible facilities, to include standalone energy storage and biogas projects, among other things. However, this percentage is increased to an alternative rate of 30% if prevailing wage and apprenticeship requirements (as detailed below) are met.

All eligible facilities can now qualify for the PTC and ITC credit regime as long as they are placed in service and begin construction prior to the end of 2024 (except as they apply to geothermal facilities, which can qualify through the end of 2034). Facilities beginning construction after December 31, 2024, will fall under the new technology-neutral 45Y and 48E tax credit regimes discussed further below.

Creation of Two-Tier Credit Regime

While the IRA expands the eligibility of the PTC and ITC, it breaks the credits into a two-tier regime consisting of a base credit (20% of the available PTC credit or 6% of the ITC) and an additional bonus credit (80% of the PTC credit or 30% of the ITC). The bonus credit is available for eligible projects that satisfy certain prevailing wage and apprenticeship requirements, as outlined by the IRA.

Prevailing Wage Requirement

Taxpayers must ensure that any laborers, mechanics, contractors or subcontractors employed are paid prevailing wages in the geographic area where the project is located (as determined by the Department of Labor’s website) during the construction of the project and with respect to subsequent alterations or repairs of the project following its placement in service. If a taxpayer fails to satisfy the prevailing wage requirement during a particular year, the Act provides an opportunity to cure the failure.

Apprenticeship Requirement

Taxpayers must ensure that, with respect to the construction of a qualified facility, no fewer than the “applicable percentage” of total labor hours are performed by qualified apprentices. The “applicable percentage” is (i) 10% for projects beginning construction before 2023, (ii) 12.5% for projects beginning construction during 2023, and (iii) 15% for projects beginning construction thereafter. Each contractor and subcontractor who employs four or more individuals to perform construction on an applicable project must employ at least one qualified apprentice. Like the prevailing wage requirement, the Act also provides opportunities for a taxpayer to cure this requirement.

The IRA provides that the prevailing wage and apprenticeship requirements will be deemed satisfied with respect to projects that begin construction prior to the date that is 60 days after the IRS publishes the relevant guidance. Importantly, the Internal Revenue Service (IRS) on November 30, 2022, published this guidance in the form of the Federal Register Notice 2022-61.[1] Thus, eligible projects had until January 29, 2023, to start construction to qualify for the full PTC or ITC without needing to satisfy the prevailing wage and apprenticeship requirements. Stated differently, projects that began construction on or after January 30, 2023 (the time of this passage) will be required to satisfy the prevailing wage and apprenticeship requirements.

Additional Bonus Credits

The Act establishes the “energy community” and “domestic content” bonus credits, each of which, independently, can provide a 10% bonus that can be stacked with each other and added to the PTC or ITC credits earned by the taxpayer.

Energy Community

Facilities sited in an “energy community” can increase the PTC or ITC credits by an additional 10%. As defined by the Act, an energy community includes brownfield sites (as defined in Comprehensive Environmental Response, Compensation, and Liability Act); an area with significant employment related to, or local tax revenues generated by, coal, oil or natural gas, and where there is high unemployment; or a census tract where a coal mine has recently closed or a coal-fired electric plant was retired or removed.

Domestic Content

Projects satisfying the Act’s “domestic content” requirements can also increase the PTC or ITC credits by an additional 10%. However, the additional tax credit is only 2%unless the project complies with the wage and apprentice requirements. The domestic content bonus incentivizes domestically produced construction materials in building a green energy production facility. The Act references the Buy America regulations used for federally funded transit projects for guidance as to what constitutes domestic content.

Low-Income Communities

The IRA also establishes an additional 10% or 20% bonus credit if a project is a qualified solar and wind facility located in a low-income community. Qualified solar and wind facilities refer to facilities that generate electricity solely from a wind or solar energy property, have a maximum net output of less than five megawatts, and are described in at least one of the following four categories:

(1) Located in a Low-Income Community;

(2) Located on Indian Land;

(3) Qualified Low-Income Residential Building Project; or

(4) Qualified Low-Income Economic Benefit Project

A “qualified low-income residential building project” is a housing program-participating rental building with a facility that evenly distributes the electricity cost savings among residents. A “qualified low-income economic benefit project” is one where at least 50%of the electricity cost savings go to households with income below 200%of the poverty line or 80% of the area’s median income.

Technology-Neutral Tax Credits

The Act also added new tax credits that apply to qualified facilities commencing construction on or after January 1, 2025, and have an anticipated greenhouse gas emissions rate of no more than zero. The Section 45Y Clean Electricity Production Credit (CEPC) and Section 48E Clean Energy Investment Credit (CEIC) will replace the PTC and ITC and are intended to be technology neutral. The credit amounts for the CEPC and CEIC will be calculated similarly to the PTC and ITC, and the prevailing wage and apprenticeship bonus requirements will be similar to the PTC and ITC.

Energy Credit Monetization

The Act amended the IRC to allow for the monetization of certain energy credits through a direct pay option that treats the credit amount as a payment against the taxpayer’s tax liability. This, effectively, makes the applicable tax credits “refundable.” Applicable entities include tax-exempt organizations, state and local governments, tribal governments, and the Tennessee Valley Authority. The IRS is yet to release guidance on whether government instrumentalities are applicable entities for the purpose of the IRA.

The Act also amended the IRC to create a transferability provision allowing entities to transfer certain credits. Section 6418 of the IRC allows some taxpayers to sell, for cash, all (or a portion of) a tax credit to an unrelated taxpayer. Although a credit can be partially transferred, it can only be transferred once, and the transfer is irrevocable. Credits eligible for transfer include the PTC, ITC, CEPC, CEIC, the Section 45Q Carbon Capture and Sequestration Credit, and the Section 45X Advanced Manufacturing Credit. Interestingly, tax-exempt entities (i.e., an “applicable entity” under § 6417 of the IRC) are not allowed to sell credits, but they are allowed to buy credits.

Summary

* Assuming a project satisfies prevailing wage and apprenticeship requirements, the Domestic Content (10 percent), Energy Community (10%), and Low-Income Community (10% or 20%) bonuses, when added to the 30% Base Credit allows for certain projects to take as high as a 70% tax credit of the qualified investment.

Conclusion

The IRA presents a wealth of opportunities for Frost Brown Todd’s clients to capitalize on their renewable energy development activities. By leveraging the tax code, the Act presents an opportunity for our clients to potentially offset a significant portion of construction costs of their clean energy electrical generation facilities and other renewable energy projects.

At Frost Brown Todd, our Renewables and Tax teams offer a full array of transactional, regulatory, litigation and advisory services to clients spanning every segment of the renewable energy space. For more information about how the Inflation Reduction Act could impact your business, please contact the authors of this article or any member of Frost Brown Todd’s Tax practice group or Renewables team.

[1] In brief, the IRS Notice, among other things, explains where to find prevailing wage rates and what to do when rates have not been published. The Notice also explains that to satisfy the IRA’s apprenticeship requirements an apprentice must be employed by a taxpayer, contractor, or subcontractor who is participating in an apprenticeship program registered under the National Apprenticeship Act. Further, the Notice explains how a taxpayer can demonstrate it made a good faith effort in requesting qualified apprentices.