Loading search

December 9, 2025 | Podcast

FBT attorney Scott Dolson teamed up with QSBSrollover.com to present five episodes for the QSBS, Sol...

December 8, 2025 | Qualified Small Business Stock (QSBS)

Section 1202 provides an exclusion from capital gain when a stockholder sells qualified small busine...

December 3, 2025 | Presidential Administration Impacts

Many staffing agencies have Form I-9 compliance issues, which could create liability and chaos for y...

December 2, 2025 | Experience

Frost Brown Todd (FBT) advised Avaz Inc., a global assistive-technology company known for its multil...

November 24, 2025 | Presidential Administration Impacts

Form I-9 compliance is essential to any successful business. The Form I-9 is a document used for ver...

November 21, 2025 | Publications

Private equity is reshaping the industrial economy at an unprecedented pace. In Navigating Private E...

November 20, 2025 | Presidential Administration Impacts

ICE has a goal of 3,000 arrests a day, which could mean thousands in fines and criminal charges for ...

November 18, 2025 | Press Releases

Frost Brown Todd’s Derrick Maultsby Jr. has been named to Pittsburgh Magazine’s 2025 “40 Under...

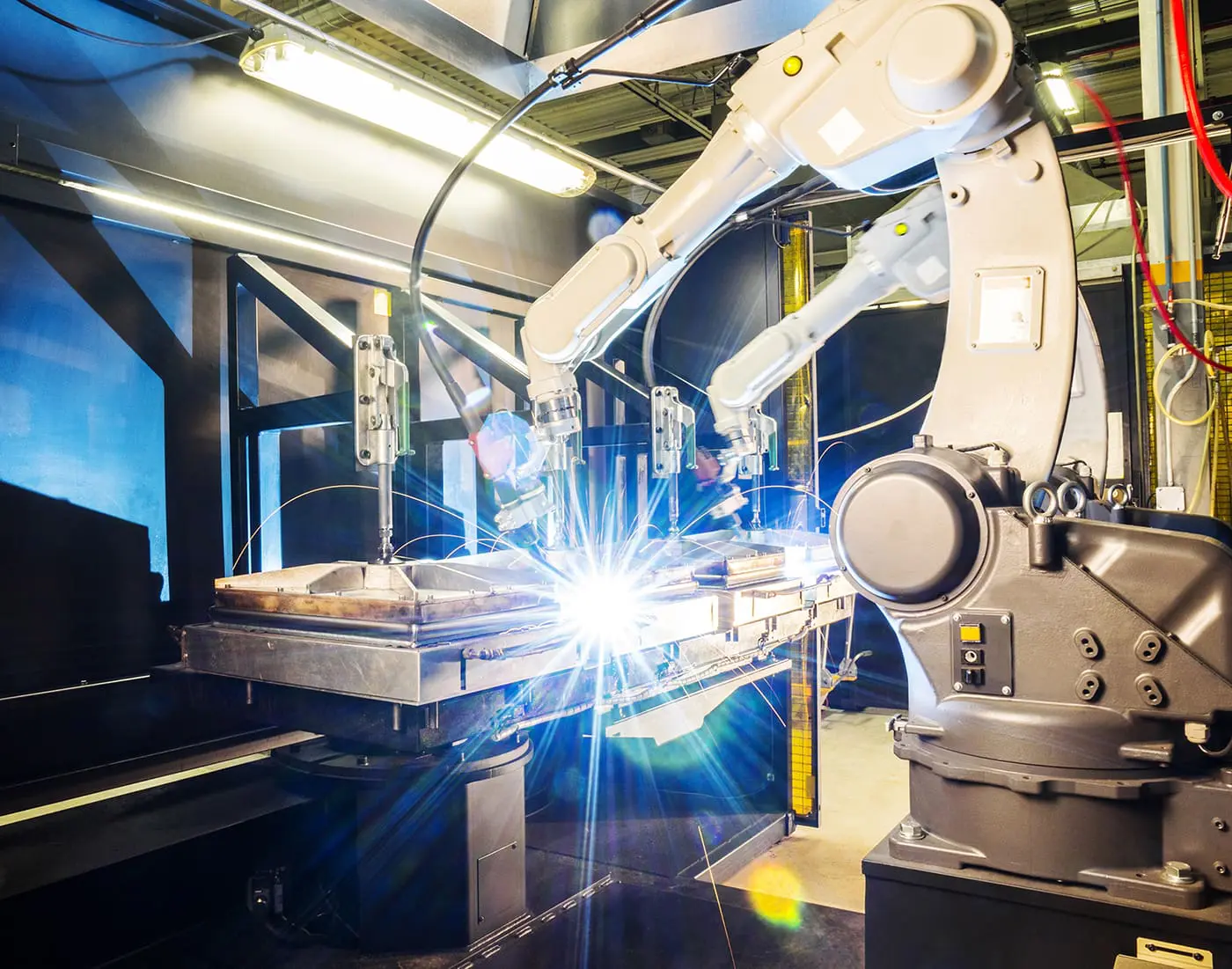

October 6, 2025 | Publications

Despite some bright spots, the landscape for U.S. manufacturing remains challenging. While supply ch...

September 30, 2025 | Publications

This article was published in collaboration with Bounce Innovation Hub, a nonprofit organization sup...

December 9, 2025 | Podcast

FBT attorney Scott Dolson teamed up with QSBSrollover.com to present five episodes for the QSBS, Sol...

December 8, 2025 | Qualified Small Business Stock (QSBS)

Section 1202 provides an exclusion from capital gain when a stockholder sells qualified small busine...

December 3, 2025 | Presidential Administration Impacts

Many staffing agencies have Form I-9 compliance issues, which could create liability and chaos for y...