*This article was originally published in the November-December 2024 issue of The Banking Law Journal.

Mezzanine lending is poised for a big year, especially in the real estate sector, as senior lending continues to slow amid economic uncertainty and declining asset values. Elevated interest rates have diminished real estate values by as much as 25%, and a general sense of economic uncertainty has many senior lenders sitting on the sidelines while others significantly tighten their lending standards.[1] According to J.P. Morgan, loan origination volume has dropped by roughly 50% from last year.[2] Meanwhile, an estimated $1.2 trillion of loans are set to mature in 2024 and 2025, and current levels of senior lending can absorb only a fraction of that volume.[3] Many current borrowers find themselves in or on the brink of a capital shortfall. And potential buyers are feeling the pain too. Senior maximum loan-to-value ratios have dropped to 55% or lower, leaving many would-be buyers with a significant gap in the capital stack.

Mezzanine lending fills that gap. The name derives from the architectural term for an intermediate story of a building positioned between two primary stories. Like its architectural counterpart, a mezzanine loan sits in the capital structure between equity and senior debt. As the gap between equity and senior debt expands, the demand for mezzanine lending grows. Current market conditions present a unique opportunity for mezzanine lenders. While mezzanine lending involves greater risk than senior lending, the risk is currently mitigated because cash flows and other operating fundamentals generally remain strong. The decline in real estate values has been driven principally by high interest rates, not diminished fundamentals.[4] So, amid growing demand for subordinate financing, mezzanine lenders can fetch premium interest rates while enjoying the security of fundamentally sound collateral.[5]

Real estate investment trusts (REITs) are among the market participants positioned to satisfy the growing demand for mezzanine lending. While most REITs focus on real estate equity, many invest in real estate-related debt such as traditional mortgage loans and mezzanine loans. For technical reasons, however, REITs are not a natural fit for the mezzanine lending space. The rules and regulations that govern REITs do not expressly contemplate mezzanine lending, and the current guidance from the Internal Revenue Service (IRS) is at odds with common mezzanine lending practices in several important respects. With demand for mezzanine finance on the rise, the IRS has an opportunity to help avert a capital crisis by updating its REIT mezzanine lending guidance, thereby unlocking a much-needed source of additional capital.

This article:

(a) provides a brief primer on mezzanine lending;

(b) summarizes the existing guidance from the IRS regarding REITs as mezzanine lenders; and

(c) discusses proposed updates to the current IRS guidance.

Mezzanine Lending

Mezzanine lending is a specific variety of subordinate or second-lien financing. Traditional second mortgages fell out of favor in the wake of the 2008 financial crisis, when both lenders and borrowers became all too aware of their drawbacks and complications, and mezzanine lending emerged as the preferred substitute. The defining difference between traditional second mortgages and modern mezzanine loans lies in the nature of the collateral. A second mortgage is secured by a lien on the subject real estate. The second mortgage lender agrees to subordinate its lien to that of the first mortgage lender pursuant to an intercreditor agreement, meaning that the first mortgage lender gets paid before the second mortgage lender. So, both lenders share the same collateral and contractually define the parameters of their relationship.

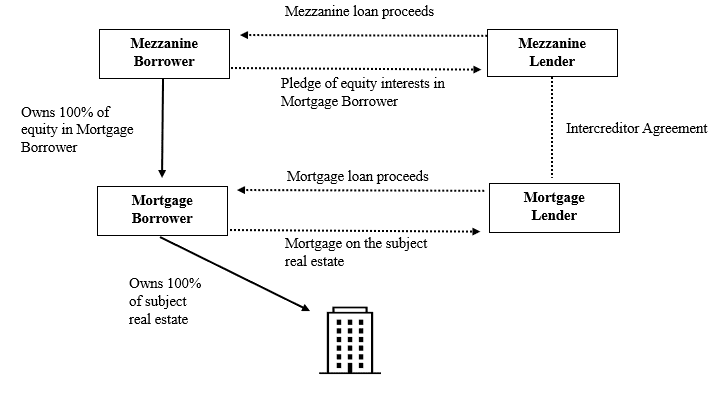

Mezzanine loans, on the other hand, are typically secured by a pledge of the equity interests in the entity that owns the subject real estate.[6] The senior lender takes a lien directly on the subject real estate, while the mezzanine lender’s lien is one level removed from the real estate in the organizational structure. A basic mezzanine loan structure looks something like this:

The mezzanine lender’s lien is subordinated to that of the mortgage lender not solely by operation of the intercreditor agreement but by its position in the organizational structure, a feature sometimes referred to as “structural subordination.” The mezzanine lender is not a creditor of the mortgage borrower and does not have a direct lien on the subject real estate. As such, the mortgage lender has lien priority as to the rents generated by the subject real estate, which represents the primary source of debt service.

The purpose of mezzanine finance is to fill the gap in the capital stack[7] between equity and senior debt (i.e., mortgage debt). Maximum loan-to-value (LTV) ratios[8] for commercial real estate mortgages often range from 55% to 65%, meaning buyers must find other sources to fund 35% to 45% of the purchase price. Many buyers prefer to fill the capital gap with mezzanine debt rather than equity because it generally comes with a lower cost of capital. Mezzanine lenders often permit maximum combined LTV ratios[9] of 80% to 90%, leaving only 10% to 20% of the purchase price for equity.

Mezzanine lending involves significantly more risk than senior lending. In the case of a foreclosure or other payment default, senior debt is repaid first, then mezzanine debt, and finally equity. As such, mezzanine debt involves elevated risk of loss. Mezzanine lenders are compensated for the additional risk with premium interest rates.

The IRS’s Mezzanine Lending Guidance for REITs

A REIT is a business entity that is taxable as a corporation for federal income tax purposes and makes a valid REIT election with the IRS. REITs generally must distribute (via dividends) at least 90% of their taxable income each year, and, unlike other C corporations, REITs receive an income tax deduction for their dividends paid. Thanks to this special income tax deduction, REITs enjoy modified pass-through status and avoid double taxation as to distributed income. This unique income tax status comes at a price, though—REITs must comply with a complicated set of tax rules and regulations that govern various aspects of their operations, including the nature of their asset holdings and the sources of their income.

The tension for REITs in the mezzanine lending space arises from two separate but related REIT requirements.

First, at least 75% of the value of a REIT’s total assets must consist of real estate assets, cash and cash items (like receivables), and government securities (this is referred to as the Asset Requirement).[10] Real estate assets include, among other things, interests in mortgages on real property.[11]

Second, at least 75% of a REIT’s gross income must derive from certain real estate-related sources, including interest on debt secured by mortgages (this is referred to as the Income Requirement, and together with the Asset Requirement, the REIT Requirements).[12]

Strict compliance with the REIT Requirements is critical. If a REIT fails to satisfy the requirements, the consequences range from adverse to catastrophic. For example, if a REIT fails to satisfy the Income Requirement, a 100% tax may be imposed on the income received from disqualifying sources.[13] In the worst-case scenario, a REIT may lose its REIT status entirely and become subject to double taxation. Because the stakes are so high, “REITs tended to take a very conservative posture, foregoing potentially lucrative investments for fear of potential disqualification.”[14]

The REIT Requirements expressly allow REITs to hold interests in mortgages, but they are silent as to mezzanine loans. As discussed above, while for practical purposes mezzanine loans are quite similar to mortgages, they are technically and legally distinct, as a mezzanine lender holds a security interest in personal property rather than a mortgage on real property. The REIT Requirements’ silence regarding mezzanine lending reflects the historical timeline, not legislative intent—the first REIT legislation was enacted in 1960, well before the advent of modern mezzanine lending structures.[15]

REITs did not find widespread use and acceptance until the 1990s,[16] but even during the obscurity of the early years, taxpayers looked to the IRS for guidance regarding the REIT Requirements and financing structures similar to modern mezzanine loans. For example, in a Revenue Ruling issued in 1977, the IRS ruled that a construction loan secured by a beneficial interest in an Illinois land trust satisfied the REIT Requirements because the subject real estate was the land trust’s sole asset.[17] The ruling rested on the fact that, “so long as the real property remains the sole asset of the land trust, the beneficial interest has no value apart from the underlying property.”[18] The land trust involved in the 1977 Revenue Ruling is strikingly similar to the single purpose entities that hold real estate and serve as collateral in modern mezzanine loan structures.

As REITs rose to prominence during the 1990s and early 2000s, the need for clear guidance regarding mezzanine lending grew. The IRS addressed this growing need in Revenue Procedure 2003-65 (referred to as the Revenue Procedure), which provides a safe harbor under which a mezzanine loan is deemed to satisfy the REIT Requirements. To qualify for the safe harbor, a mezzanine loan must satisfy the following requirements:

- The borrower is either a partner in a partnership or the sole member of a disregarded entity;[19]

- The loan must be nonrecourse, secured only by the partner’s interest in the partnership or the member’s interest in the disregarded entity;

- The lender must have a first priority security interest in the pledged ownership interest;

- Upon default and foreclosure, the lender will replace the borrower as a partner in the partnership or as the sole member of the disregarded entity, and if a partnership, the other partners must have agreed to not unreasonably oppose the admission of the lender as a partner;

- When the loan commitment becomes binding on the lender, the partnership or disregarded entity must hold real property, and if the real property is subsequently sold or transferred in whole or in part, the loan will become due upon such sale or transfer;

- The value of the real property must remain at least 85% of the value of all of the assets of the partnership or disregarded entity;

- The fair market value of the real property as of the loan commitment date (as reduced by the amount of any senior liens or liabilities) must be at least equal to the loan amount; and

- Interest on the loan must consist solely of compensation for the use or forbearance of money, and the interest amount may not depend in whole or in part on the income or profits of any person, except the interest amount may be a fixed percentage of the borrower’s receipts or sales.

The Revenue Procedure was the IRS’s last significant statement regarding REITs as mezzanine lenders, and as such, it has been the primary source of guidance on this subject for REITs and their legal counsel ever since.

Proposed Updates to the IRS’s Guidance

The Revenue Procedure offers a safe harbor, it does not establish the exclusive criteria for measuring compliance with the REIT Requirements. In other words, a REIT mezzanine lender might comply with the REIT Requirements even if it does not satisfy the Revenue Procedure’s criteria.[20] The purpose of the Revenue Procedure is to provide certainty—it is currently the only means to establish beyond doubt that a mezzanine loan complies with the REIT Requirements. In the unforgiving world of REIT compliance, even a sliver of doubt can have a significant chilling effect.[21] As discussed above, failure to comply with the REIT Requirements can unleash a menagerie of gruesome consequences, including loss of REIT status altogether and imposition of a corporate-level tax.[22] As such, many REITs are simply unwilling to take the slightest gamble on their REIT compliance.[23] If REITs are going to do their part to meet the growing need for mezzanine financing, it is critical to have a reliable, workable safe harbor.

REITs have been active in mezzanine finance during the decades since the IRS issued the Revenue Procedure.[24] Earlier this year, CareTrust REIT participated in the origination of over $52 million in mezzanine loans secured by portfolios of skilled nursing and assisted living properties.[25] Last year, 3650 REIT originated a $103 million mezzanine loan in connection with the recapitalization of a portfolio of multifamily properties.[26]

Yet, while some REITs have entered the mezzanine lending space, many have avoided it due to certain problematic aspects of the Revenue Procedure. Several of the Revenue Procedure’s criteria conflict with standard mezzanine lending practices. The two most commonly cited problems are: (1) the requirement that the loan be nonrecourse, and (2) the requirement that the loan immediately accelerate if even part of the underlying real estate is sold or transferred.[27] Some of the problematic lending practices, such as recourse provisions, are designed to mitigate the heightened risk of loss involved in mezzanine lending. So, REIT mezzanine lenders currently must choose between heightened risk of losing their REIT status or heightened risk of losing their investment. Faced with these unpalatable options, many REITs have simply avoided the mezzanine lending space altogether.

For those REITs that have entered the mezzanine lending market, the practical and commercial gaps left unaddressed by the Revenue Procedure have necessarily been filled by the advice of tax advisors. Specifically, as further discussed below, tax counsel is often called upon to weigh in on such common commercial features as multiple-tier mezzanine loans, mezzanine loans with recourse features, and mezzanine loans with partial release provisions allowing for sales of some, but not all, of the underlying real estate. As is often the case, the advice and level of comfort a REIT receives on these topics varies from advisor to advisor, resulting in uneven practices across the market.

The need for mezzanine financing is growing rapidly. Maximum LTV ratios for commercial mortgages are low, and senior lenders have tightened their underwriting standards.[28] So, senior credit is in short supply while an estimated $1.2 trillion of existing loans are set to mature in 2024 and 2025.[29] Many of those borrowers must refinance or face receiverships and bankruptcy. Mezzanine lending will play a key role in avoiding a credit crisis, and REITs could be a significant source of mezzanine financing. However, many REITs will continue to shun mezzanine lending as long as the available safe harbor remains in conflict with standard mezzanine lending practices.

The IRS has an opportunity to help avoid a credit crisis by updating the Revenue Procedure to align it with common mezzanine lending practices. A commercially viable safe harbor would draw more REITs into mezzanine lending, thereby providing more capital to meet the growing demand for subordinate financing. An updated safe harbor would also help standardize and streamline mezzanine lending practices among REITs, which are currently balkanized due to varying practices and standards among tax advisors in the absence of IRS guidance in sync with commercial practice. As such, the IRS should make the following updates to the Revenue Procedure.

Contingent Recourse Provisions and Guarantees

The Revenue Procedure currently requires that the mezzanine loan be entirely nonrecourse, meaning that, upon an event of default, the lender’s sole remedy is to foreclose upon the collateral. The lender may not sue the borrower for damages or pursue other economic remedies directly against the borrower. This requirement conflicts with common mezzanine lending practices that allow recourse directly against the borrower upon certain contingencies. The requirement also appears to prohibit supporting guarantees, which are common features of modern mezzanine loans.

The Revenue Procedure should be updated to allow an otherwise nonrecourse mezzanine loan to become recourse if the borrower or a borrower affiliate violates any of its non-financial obligations under the loan documents.[30] Such provisions are often called “bad boy carveouts,” and they are very common among mezzanine lenders.

The Revenue Procedure should also allow mezzanine lenders to obtain guarantees or pledges from parties related to the borrower, provided that the lender may invoke the guarantee or pledge only if it has exhausted all its remedies against the collateral (i.e., foreclosure).[31] This is also a very standard feature of modern mezzanine loans.

Partial Sale of the Underlying Real Estate

The Revenue Procedure currently requires that the mezzanine loan fully accelerate[32] if any part of the underlying real estate is sold. This requirement is problematic for mezzanine loans secured by multiple underlying properties. A purchaser of a portfolio of real estate assets generally will not agree to pay off the loan in full if a single property is sold. Mezzanine loan agreements secured by multiple underlying properties typically require that, upon the sale of one or more properties, the borrower must use either all or at least a proportional amount of the sale proceeds to pay down the loan.

The Revenue Procedure should be updated to provide that the mezzanine loan is not required to be paid in full upon a partial sale of the underlying real estate, as long as the loan value[33] of the real estate that remains after the sale is equal to or greater than the outstanding principal amount of the mezzanine loan.[34] This proposed update is consistent with the handling of mortgage loans under the REIT Requirements. For example, if a mortgage encumbers both real estate and other property, all the interest payable is deemed to be received from the real estate for purposes of the Income Requirement as long as the loan value of the real estate equals or exceeds the amount of the loan.[35]

Multiple Mezzanine Levels

The Revenue Procedure currently requires that the mezzanine lender must have a pledge of the equity interests of the entity that owns the underlying real estate. This requirement contemplates only a single level of mezzanine financing. In practice, however, a single mezzanine loan is often not sufficient to fill the entire gap in the capital stack, in which case the borrower may obtain one or more junior mezzanine loans. A junior mezzanine loan is structurally subordinated to the senior loans, similar to the mezzanine loan illustrated in the graphic above, but it is further removed from the underlying real estate in the organizational structure. For example, the junior mezzanine borrower typically owns 100% of the first mezzanine borrower, and the first mezzanine borrower owns 100% of the LLC that holds the real estate. The junior mezzanine borrower pledges its ownership interest in the first mezzanine borrower as collateral for the junior mezzanine lender. Under the Revenue Procedure, REITs are permitted to lend only at the first mezzanine level.

If REITs are limited to lending only at the first mezzanine level, it will significantly impair their ability to serve the growing need for mezzanine financing. As such, the Revenue Procedure should be updated to provide that a junior mezzanine loan complies with the REIT Requirements as long as (1) the loan is secured by a pledge of the equity interests in an entity that, indirectly through one or more intermediate disregarded entities, owns an interest in a disregarded entity that holds real estate, and (2) each intermediate disregarded entity owns no more than a de minimus amount of non-real estate assets.[36]

Partnership Agreement Provisions

Under the Revenue Procedure, if a mezzanine loan is secured by an interest in a partnership, the partnership agreement must provide that, upon a default and foreclosure, the other partners will not unreasonably oppose the admission of the mezzanine lender as a partner. This requirement is problematic because most partnership agreements do not include such a provision. The purpose of the requirement appears to be ensuring that, upon a default and foreclosure, the REIT will have indirect access to the underlying real estate to satisfy the debt. That purpose is adequately served without the problematic provision, however, as long as the partnership agreement and applicable law do not impede the pledge of partnership interests or the admission of new partners. As such, the existing partnership agreement requirement should be modified to require, instead, that the partnership agreement and applicable law must not (1) prohibit the partners from pledging or otherwise encumbering their partnership interests, or (2) require the consent of the other partners for the admission of a new partner.[37]

Conclusion

The need for mezzanine financing is real and growing. Commercial properties around the country are sliding into receivership, hire-rise towers are boarding up windows, borrowers and lenders are struggling to negotiate workouts. We all have a shared interest in avoiding a credit crisis. REITs represent a much-needed source of additional mezzanine financing, but the Revenue Procedure in its current form keeps too many REITs on the sidelines. The IRS should seize the moment and unlock this trove of additional capital by updating the Revenue Procedure as described above.

To discuss REITs or mezzanine lending, contact the author, Scott J. Bent.

[1] J.P. Morgan Asset Management, Real Estate Mezzanine Debt Outlook, January 16, 2024, real-estate-mezzanine-debt-outlook.pdf (jpmorgan.com).

[2] Id.

[3] Id.

[4] Id.

[5] It bears mentioning that the terms of the senior loan may limit or otherwise impact a mezzanine lender’s access to the collateral.

[6] As discussed below, sometimes borrowers obtain a senior mezzanine loan and one or more junior mezzanine loans. In terms of the diagram displayed in this section, the senior mezzanine loan would be secured by the equity interests in the Mortgage Borrower, and, assuming there is only a single junior mezzanine loan, the junior loan would be secured by the equity interests in the Mezzanine Borrower. An additional entity would be formed to own 100% of Mezzanine Borrower, and that entity would be the Junior Mezzanine Borrower.

[7] The term “capital stack” refers to the financing package in connection with the acquisition or refinancing of real estate or other assets. The capital stack in connection with a real estate transaction often consists of:

(a) Equity;

(b) A mortgage loan; and

(c) One or more mezzanine loans.

[8] The loan-to-value (LTV) ratio is the ratio between the original principal loan amount and the appraised value of the collateral. LTV ratios are typically expressed as a percentage of the collateral’s appraised value. For example, if the collateral has an appraised value of $100 million and the lender’s maximum permitted LTV ratio is 55%, then the loan amount may not exceed $55 million.

[9] The combined LTV ratio includes the balances of both the mortgage and mezzanine loans. So, if a mortgage lender has a maximum LTV ratio of 55% and a mezzanine lender an additional 30%, the combined maximum LTV ratio is 85%.

[10] 26 U.S.C. § 856(c)(4)(A).

[11] 26 U.S.C. § 856(c)(5)(B).

[12] 26 U.S.C. § 856(c)(3)(B).

[13] 26 U.S.C. § 857(b)(5).

[14] Real Estate Investment Trusts, by Micah Bloomfield, Evan Hudson, and Mitchell Snow. Chapter 2, Section 2:52; see also New York State Bar Association Tax Section, Report on Revenue Procedure 2003-65, May 6, 2008 (“[M]any REITs will not own an asset such as a mezzanine loan unless there is certainty that their ownership of the asset and the associated income from the asset will not jeopardize its REIT status.”).

[15] “Once a Mortgage, Always a Mortgage”—The Use (and Misuse) of Mezzanine Loans and Preferred Equity Investments, by Andrew R. Berman, 11 Stan. J.L. Bus. & Fin. 76 (2005).

[16] A Theory of the REIT, by Jason S. Oh and Andrew Verstein, 133 Yale L.J. 755, 768 (2024).

[17] Revenue Ruling 77-459, 1977-2 C.B. 239.

[18] Id.

[19] Under the federal income tax rules, a “disregarded entity” is any entity (typically an LLC) that has a single owner and has not elected to be taxed as a separate entity. A disregarded entity is treated as if it does not exist for federal income tax purposes.

[20] See, e.g., New York State Bar Association Tax Section, Report on Revenue Procedure 2003-65, May 6, 2008.

[21] See note 14 and the corresponding text (“REITs tended to take a very conservative posture, foregoing potentially lucrative investments for fear of potential disqualification.”).

[22] See note 14 and the corresponding text.

[23] New York State Bar Association Tax Section, Report on Revenue Procedure 2003-65, May 6, 2008 (“[I]n light of the potentially catastrophic consequences to a REIT that fails to satisfy the asset and income tests (i.e., a corporate level tax) many taxpayers and their advisors effectively view the safe harbor as providing for an exclusive set of requirements that must be satisfied in order to conclude that mezzanine loans qualify as real estate assets for tax purposes.”); see also note 14 and the corresponding text.

[24] See, e.g., Mortgage REIT Mezzanine Deals Set to Grow, NAREIT, January 25, 2013, Mortgage REIT Mezzanine Deals Set To Grow | Nareit.

[25] CareTrust REIT Provides $52 Million in Mezzanine Financings, CareTrust REIT: CareTrust REIT Provides $52 Million in Mezzanine Financings | CareTrust REIT Inc..

[26] Multi-Housing News, 3650 REIT Originates $103M Portfolio Loan, June 1, 2023, available at 3650 REIT Originates $103M Portfolio Loan – Multi-Housing News (multihousingnews.com).

[27] Real Estate Investment Trusts Handbook, by Peter M. Fass, Michael E. Shaff, and Donald B. Zief. Chapter 5, Section 5:53; see also Tax-Advantaged Securities, by Robert J. Haft, Peter M. Fass, Michele Haft Hudson, and Arthur F. Haft. Chapter 25, Section 25:145.

[28] J.P. Morgan Asset Management, Real Estate Mezzanine Debt Outlook, January 16, 2024, real-estate-mezzanine-debt-outlook.pdf (jpmorgan.com).

[29] Id.

[30] See New York State Bar Association Tax Section, Report on Revenue Procedure 2003-65, May 6, 2008.

[31] Id.

[32] Fully accelerating the loan means that the entire outstanding balance becomes due immediately.

[33] As used in the REIT rules, the term “loan value” means the fair market value of the applicable real estate, as reduced by the amount of any senior debt.

[34] See New York State Bar Association Tax Section, Report on Revenue Procedure 2003-65, May 6, 2008.

[35] Treasury Regulation Section 1.856-5(c)(1)(i)

[36] See New York State Bar Association Tax Section, Report on Revenue Procedure 2003-65, May 6, 2008.

[37] Id.