*This article was updated on July 22, 2025.

Section 1202 provides for a substantial exclusion of gain from federal income taxes when stockholders sell qualified small business stock (QSBS).[1] A number of requirements must be met before a stockholder is eligible to claim Section 1202’s gain exclusion. Those requirements have been addressed in a series of articles on Frost Brown Todd’s website. This article focuses on the planning challenges facing S corporation owners interested in pursuing the benefits of Section 1202’s gain exclusion. Additional information can be found on our QSBS & Tax Planning Services page.

The following points illustrate why S corporations and QSBS don’t play together well:

- Only C corporations can issue QSBS.[2] Stock issued by an S corporation can never qualify as QSBS, even if such S corporation subsequently converts to be classified as a C corporation for federal income tax purposes.[3] But as discussed below, an S corporation is included among “pass-thru” entities under Section 1202 and can hold and sell QSBS, passing capital gain through to stockholders who are eligible to claim Section 1202’s gain exclusion.

- Stock doesn’t qualify as QSBS unless the issuing corporation is classified as a C corporation during “substantially all” of a taxpayer’s QSBS holding period.[4] Conversion of a C corporation to an S corporation generally results in the termination of the QSBS status of the outstanding stock, unless the S corporation holding period is short and is terminated before the stock is sold.

- The corporation issuing QSBS must generally be a C corporation when the QSBS is sold. If a C corporation issues stock intended to be QSBS, such stock will not actually be QSBS if the corporation is an S corporation at the time of the stock sale.[5]

S corporations are pass-through entities for federal income tax purposes as each shareholder recognizes his pro rata share of the S corporation’s items of income (including tax-exempt income), loss, deduction, or credit reported annually to such shareholder on IRS Schedule K-1. There is nothing wrong with operating a business through an S corporation, and many owners benefit from a pass-through entity tax regime, but business owners seeking Section 1202’s gain exclusion must operate their business through a C corporation. As noted above, stock issued while a business operates through an S corporation can never qualify as QSBS, although QSBS can be issued once the business is converted to C corporation status. If a C corporation with outstanding QSBS makes an S corporation election, the corporation will no longer qualify as qualified small business under Section 1202, and the outstanding stock will no longer qualify as QSBS (see the discussion below regarding the possible conversation back to C corporation status as a fix for the problem).

There are two approaches available for converting a business operated through an S corporation into a business operated through a domestic (US) C corporation.

Owners of S corporations have two options if they decide to seek the benefits of QSBS and the flat 21% federal income tax rate applicable to C corporations. If the “restructuring” approach is chosen, it is important that business owners can establish bona-fide business reasons (i.e., non-tax avoidance reasons) for selecting a restructuring over merely terminating the corporation’s S corporation election (see the discussion below).

OPTION 1: Exchange of business assets or LLC membership interest for QSBS (the restructuring approach)

This approach basically turns the S corporation into a stockholder (pass-thru owner) of a newly-organized C corporation. To accomplish this restructuring, the historic S corporation either

- makes a direct contribution of its assets, contracts and liabilities to a domestic (US) C corporation (Newco) in exchange for Newco stock intended to qualify as QSBS. One benefit of this approach is that unlike the second alternative, Newco is not required to assume the liabilities, tax or otherwise, of the historic S corporation. But if this approach is selected, there will be an actual assignment of assets, liabilities, contracts, permits, etc., and the business will need to operate under a new EIN (Newco’s EIN).

or alternatively,

- the historic S corporation first undergoes a restructuring treated as a Type F reorganization[6] that results in the formation of a new S corporation holding company (Holdco) and involves the conversion of the historic S corporation business into a single-member LLC subsidiary of Holdco. Holdco then contributes the single-member LLC interest to Newco and Newco issues the stock intended to qualify as QSBS to Holdco. When the dust settles, Holdco (an S corporation), owns the stock of a domestic (US) C corporation (Newco).[7] The expectation is that the Newco stock will meet Section 1202’s eligibility requirements to qualify as QSBS. Undertaking the initial Type F reorganization has the additional benefit of permitting the operating business (i.e., the S corporation) to retain its historic EIN. In many cases, Newco will be organized as a Delaware corporation given the familiarity of investors and advisors with Delaware’s corporations law and the Delaware judiciary.

OPTION 2: Terminate S corporation election

The corporation’s S corporation election can simply be terminated by revoking the election and the corporation will revert to C corporation status.

Shareholders can simply revoke the S corporation election if they aren’t concerned about whether the corporation’s outstanding stock benefits from QSBS. As noted above, stock issued by an S corporation can never qualify as QSBS. But, additional stock issued by the newly-converted C corporation can qualify as QSBS. A possible strategy associated with revocation of the S corporation election would be to recapitalize the corporation with preferred and common stock, with liquidation preference of the preferred approximating the corporation’s fair market value, and issue additional “cheap” common stock for money, contribution of property or performance of services, each of which is permissible under Section 1202.[8] Based on the valuation methodologies used in connection with Section 409A valuations (typically based on valuing the common stock after subtracting the liquidation preference of the preferred), the value of the newly-issued common stock should be low, which allows for the issuance of the “cheap” common stock. But an obvious issue with this strategy is that the historic S corporation stockholders will not be holding QSBS and may not be interested in diluting participation in future corporate growth through the issuance to other stockholders of a substantial block of “cheap” common stock.

The results of a restructuring are usually favored over those of a mere S corporation election termination.

In most cases, existing S corporation stockholders prefer to position themselves to at least partially qualify for Section 1202’s gain exclusion with respect to their historic S corporation stock. As discussed below, the rules of Section 1202 preclude claiming a gain exclusion for any appreciation in the business assets/goodwill that occurred prior to the restructuring outlined above, but the restructuring, in contrast to the mere termination of S corporation status discussed below, potentially allows the S corporation stockholders to share in appreciation in the value of the business through their historic S corporation stock ownership. The alternative would be to terminate the S corporation election and participate in corporate growth through the purchase of newly-issued Newco stock.

Leto v. United States[9]: A conversion approach that failed

In Leto, an LLC operating was operating with S corporation status, but its owners apparently wanted to convert to C corporation status. The conversion was undertaken through the merger of the S corporation into a Delaware C corporation, with the Delaware C corporation the survivor in the merger. Later, one of the original S corporation stockholders claimed Section 1202’s gain exclusion in connection with a sale of his Delaware C corporation stock. The IRS challenged the claimed gain exclusion, and the Federal District Court Judge concluded that the taxpayer did not qualify for the gain exclusion because the conversion transaction was structured as a stock-for-stock exchange. Since the stock sold by the taxpayer was received in exchange for S corporation stock, the stock failed Section 1202 “original issuance” requirement. A cardinal rule of Section 1202’s original issuance requirement is that stock originally issued by an S corporation can never qualify as QSBS. Stock is QSBS only if it is originally issued by a C corporation. A taxpayer should have a better result if the corporation in Leto contributed its assets to the newly-organize Delaware corporation in a Section 351 nonrecognition exchange in exchange for C corporation stock. The asset contribution in exchange for C corporation stock should satisfy Section 1202’s original issuance requirement.

A more in-depth look at the tax consequences of the restructuring approach to converting a business to C corporation status.

Section 1202 contemplates that Holdco, as an S corporation “pass-thru entity” (as such term is defined in Section 1202(g)(4)), can own and sell QSBS, passing through capital gain that can be excluded by Holdco’s stockholders if the stock of Newco has met all of Section 1202’s eligibility requirements. Section 1202 provides that when property (the assets or LLC interest of the historic operating business) is contributed by Holdco to Newco, the basis of Holdco in the QSBS issued in exchange is no less than the fair market value of the contributed property contributed.[10] The special “Section 1202 tax basis” established by Section 1202(i)(2)(B) is significant for two reasons. First, because the tax basis of contributed property is equal to fair market value (FMV) for purposes of Section 1202, the contributor won’t be entitled to claim the Section 1202 gain exclusion for any gain attributable to the pre-contribution period. For example, if contributed property has a regular tax basis of zero and a Section 1202 tax basis (i.e., FMV) of $10 million, the later sale of the QSBS for $80 million would trigger recognition of $10 million of capital gain and a potential $70 million gain exclusion under Section 1202. Second, the minimum per-taxpayer (in this case, each S corporation stockholder) gain exclusion cap is $10 million ($15 million for QSBS issued after July 4, 2025) for gain arising out of the sale of Newco’s QSBS. But Section 1202(b)(1)(B) provides an alternative gain exclusion cap (commonly referred to as the “10X Cap”) which is “10 times the aggregate adjusted bases of qualified small business stock issued by such corporation and disposed of by the taxpayer during the taxable year.” In the example above, assuming there are two 50% stockholders, each stockholder would be allocated $5 million of “Section 1202 tax basis” and thus would qualify for up to $50 million in gain exclusion under Section 1202 (e.g., the 10X cap would allow for a potential per-stockholder potential Section 1202 gain exclusion of 10X x $5 million = $50 million). An important aspect of dealing with the Section 1202(i)(2)(B) basis issue is substantiating the FMV of the contributed property for purposes of Section 1202(i)(2)(B), which typically means obtaining an independent appraisal.[11]

Holdco’s (and indirectly its stockholders’) holding period for Newco QSBS commences when the QSBS is issued in a restructuring. Newco often issues additional QSBS to investors and service providers either as part of or sometime after the Section 351 nonrecognition exchange (subject to taking into account Section 351’s “control immediately after the exchange” requirements).

The sharing of Section 1202’s gain exclusion among S corporation stockholders is based on ownership of Holdco stock as of the date of a restructuring. A transferee of the S corporation Holdco stock after the date of QSBS issuance won’t share in the Section 1202’s gain exclusion. The holder of S corporation stock issued after the date of QSBS issuance won’t share in Section 1202’s gain exclusion.

Section 1045 Treasury Regulations contemplate that a transferee of a gifted partnership interest can share in Section 1202’s gain exclusion, but there is no comparable provision for gifting of S corporation stock. Obviously, any gifting or other transfers or issuances of S corporation stock should occur before the restructuring. Post-restructuring gifts would need to be undertaken using QSBS issued by the C corporation.

An S corporation holding the stock of a C corporation can sometimes result in troublesome tax issues. For example, a problem could arise if there is a desire to distribute earnings out of Newco to the S corporation. If the S corporation has earnings and profits (generally arising prior to the S corporation election), distributions would be treated as passive income, which could trigger the termination of the S corporation election under Section 1362(d)(3) and the imposition of a 25% tax on the excess net passive income under Section 1375. Planning should focus on structuring non-passive payments. On the flip side, retaining excess earnings in Newco can trigger both excess working capital problems under Section 1202 and potential exposure to the accumulated earning tax.

The importance of substantiating a bona-fide business purpose for undertaking a restructuring.

As mentioned above, business owners who elect to convert into a C corporation have two ways to accomplish that goal. They can simply terminate the S corporation election and issue additional QSBS for money, property or services, or they can undertake a restructuring described above, with Newco (the newly-organized C corporation) issuing QSBS to Holdco in exchange for the contribution of the operating business assets to Newco.

Before selecting the proper alternative, an important first step is to substantiate that decisions made by the Board of Directors and stockholders were made for bona-fide business reasons (i.e., not for tax avoidance). The IRS has a history of asserting “pervasive judicial doctrines” to attack taxpayers whose transactions satisfy the required statutory “form” but are not what, in the opinion of the IRS, Congress intended. One of these doctrines provides the basis for the IRS arguing that taxpayers must have a bona-fide business purpose for undertaking a transaction beyond tax benefits. While there are tax authorities supporting the conclusion that if there are two ways to achieve an end result, the taxpayer is not obligated to select the path that results in higher taxes, it makes sense from a practical standpoint to have a reasoned response if asked why a restructuring was selected in lieu of merely terminating an S corporation election. It is important to keep in mind that taxpayers bear the burden of proof if the IRS challenges a return position. In situations where the IRS asserts a tax avoidance purpose for a transaction, a taxpayer must not only have undertaken a transaction for bona-fide business reasons but also must be prepared to produce credible substantiation that those business reasons were the driving force behind the decision of the Board of Directors and owners to select the chosen form of conversion transaction (here the restructuring).

Not surprisingly for those who have been involved with corporate restructuring and M&A transactions, there are a number of business reasons why a restructuring might be selected over the mere termination of the S corporation election. For example, family business owners often engage in wealth and estate planning at the S corporation level using trusts and gifts of S corporation stock as vehicles to accomplish various non-tax goals. When it comes time to convert to a C corporation, there is often a desire to leave the S corporation intact rather than terminate the S corporation election and bring in additional investors and employees as stockholders. In some cases, there are business and investment assets owned through the S corporation that are not contributed into Newco, which tips the scale in favor of a restructuring, as distributing those assets out of the S corporation before converting to C corporation status would trigger a deemed taxable sale. Selecting the restructuring results in a parent-subsidiary arrangement, which can be favored both from an asset protection and financing standpoint. The restructuring’s three-tier entity structure brings with it flexibility to issue incentive equity at both the Newco and operating LLC level. Assuming Newco is a Delaware corporation, another valid business reason for the restructuring might be that it facilitates re-domesticating the operating business to a jurisdiction where investors are generally more comfortable investing in a newly-organized corporation Delaware corporation than a re-purposed former S corporation. The preceding non-tax business purposes are just a sampling of some of the reasons why a restructuring might be the favored and correct choice for business reasons.

What options are available for a business that issued C corporation stock but later elected S corporation status?

In some cases, stock was issued by a C corporation that later made an S corporation election.[12] Under those circumstances, simply terminating the S corporation election might be a viable option, if the stockholders would later satisfy Section 1202’s requirement that the QSBS was issued by a corporation that was a C corporation for “substantially all” of the stockholders’ QSBS holding period. Unfortunately, what constitutes “substantially all” has not been defined by tax authorities for purposes of Section 1202. Other tax authorities have defined “substantially all” to mean as much as 95% or as little as 51% of the applicable measurement period. For planning purposes, “substantially all” should fall somewhere between 70% to 95% of a stockholder’s QSBS holding period. For example, Section 1202’s “substantially all” requirement might be satisfied if a business has the status of C corporation when stock is first issued and when it is sold, and the corporation operated as a C corporation during eight out of 10 years (80%) of a stockholder’s QSBS holding period.

Are there planning options for business owners interested in Section 1202’s benefits if their corporation issued stock as an S corporation and is now operating as an C corporation?

Good planning options are limited where the S corporation has already terminated the S corporation election is now operating as a C corporation. The C corporation can simply issue additional stock that qualifies as QSBS, and purchases of additional common or preferred stock by investors would work fine. But that leaves the original S corporation stockholders holding non-QSBS and employees being granted QSBS as incentive equity a potentially large tax bill since a Section 83(b) election would be necessary to commence the running of the QSBS holding period.

A possible approach that at least partially solves some of the issues identified above would be to recapitalize the corporation with preferred and common stock, causing the value of the common stock to be depressed by the liquidation preference of the outstanding preferred stock (similar to the recapitalization plan discussed above). The C corporation could then issue additional common stock for money, contribution of property or performance of services. The terms of the preferred stock must be carefully structured to avoid triggering ordinary income treatment when the stock is sold to a third party.[13]

Please contact Scott Dolson if you want to discuss any Section 1202 or Section 1045 issues by video or telephone conference. You can also visit our QSBS & Tax Planning Services page for more QSBS-related analysis curated by topic, from the choice of entity decision and Section 1202’s gain exclusion to Section 1045 rollover transactions.

More QSBS Resources

- Substantiating the Right to Claim QSBS Tax Benefits | Part 1

- Substantiating the Right to Claim QSBS Tax Benefits | Part 2

- One Big Beautiful Bill Act Doubles Down on QSBS Benefits for Startup Investors

- Finding Suitable Replacement Qualified Small Business Stock (QSBS) – A Section 1045 Primer

- Guide to Converting Partnerships (LLCs/LPs) into C Corporation Issuers of QSBS – Part 1

- Guide to Converting Partnerships (LLCs/LPs) into C Corporation Issuers of QSBS – Part 2

- Structuring the Ownership of Qualified Small Business Stock (QSBS) – Is There a Role for Roth IRAs?

- Dealing with Excess Accumulated Earnings in a Qualified Small Business – A Section 1202 Planning Guide

- Section 1202 (QSBS) Planning for Sales, Redemptions and Liquidations

- Can Stockholders of Employee Leasing or Staffing Companies Claim Section 1202’s Gain Exclusion?

- Qualified Small Business Stock (QSBS) Guidebook for Family Offices and Private Equity Firms

- Conversions, Reorganizations, Recapitalizations, Exchanges and Stock Splits Involving QSBS

- Navigating Section 1202’s Redemption (Anti-churning) Rules

- A Section 1202 Walkthrough: The Qualified Small Business Stock Gain Exclusion

- A SPAC Merger Primer for Holders of Qualified Small Business Stock

- Determining the Applicable Section 1202 Exclusion Percentage When Selling Qualified Small Business Stock

- Selling QSBS Before Satisfying Section 1202’s Five-Year Holding Period Requirement?

- Part 1 – Reinvesting QSBS Sales Proceeds on a Pre-tax Basis Under Section 1045

- Part 2 – Reinvesting QSBS Sales Proceeds on a Pre-tax Basis Under Section 1045

- Section 1202 Qualification Checklist and Planning Pointers

- A Roadmap for Obtaining (and not Losing) the Benefits of Section 1202 Stock

- Maximizing the Section 1202 Gain Exclusion Amount

- Dissecting 1202’s Active Business and Qualified Trade or Business Qualification Requirements

- Recapitalizations Involving Qualified Small Business Stock

- The 21% Corporate Rate Breathes New Life into IRC § 1202

[1] References to “Section” are to sections of the Internal Revenue Code of 1986, as amended. Many states, but not all, including notably California and New Jersey, do not follow the federal treatment of QSBS.

[2] Section 1202(c)(1).

[3] Section 1202(c)(1)(A) provides that QSBS is stock in a C corporation if “as of the date of issuance, such corporation is a qualified small business.” Section 1202(d)(1) provides that “the term ‘qualified small business’ means any domestic corporation which is a C corporation. . .”

[4] Section 1202(c)(2)(A).

[5] Section 1202 deals with the consequences of selling QSBS. Section 1202(c)(1) provides that the term “qualified small business stock” means “any stock in a C corporation. . .”

[6] Section 368(a)(1)(F).

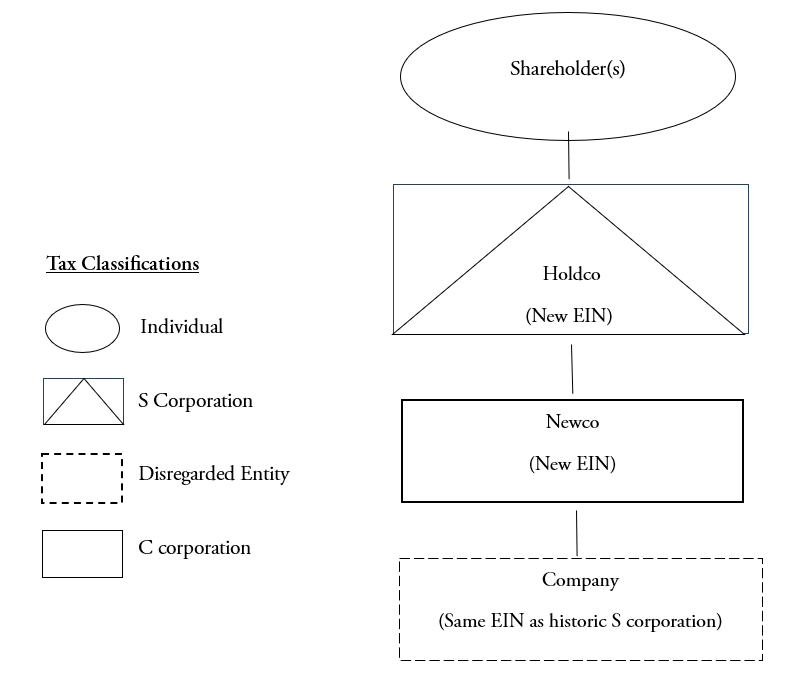

[7] This option involves first organizing a new corporation (Holdco) and contributing the existing S corporation stock to Holdco, followed by making a QSub election on IRS Form 8869 (with the Type F reorganization box checked), followed by the conversion of the subsidiary QSub to a disregarded LLC, and finally followed by the contribution of the single-member LLC interest to a newly-organized C corporation (Newco) in exchange for QSBS. The contribution of the single-member LLC interest (which is treated as a property contribution) and issuance of QSBS is intended to qualify as a Section 351 nonrecognition exchange. The steps of a Type F reorganization restructuring are illustrated in Appendix A below.

[8] If this approach is consideration, the parties would need to navigate through the possible application of Sections 305 and 306.

[9] Leto v. United States, No. CV-20-02180-PHX-DWL (D. Ariz. 2022).

[10] Section 1202(i)(2)(B).

[11] For purposes of substantiating charitable contributions, Section 170(f)(11)(ii) provides that the term “qualified appraiser” means an individual who (1) has earned an appraisal designation from a recognized professional appraiser organization or has otherwise met minimum education and experience requirements set forth in regulations prescribed by the Secretary, and (2) regularly performs appraisals for which the individual receives compensation. Section 170(f)(11)(E)(iii) provides that an individual will not be treated as a qualified appraiser with respect to any specific appraisal unless that individual demonstrates verifiable education and experience in valuing the type of property subject to the appraisal. It seems reasonable that appraisers with similar qualifications would carry the greatest weight in connection with QSBS related appraisals.

[12] Stock issued as of the date of an S corporation’s formation would not be considered as being issued by a C corporation in the situation where the Form 2553 S corporation election is made after the date of issuance of the stock but relates back to the date of the corporation’s formation. For federal income tax purposes, the stock issued on day one would be treated as having been issued by an S corporation.

[13] The potential application of Sections 305 and 306 should be considered.

Appendix A

Transaction steps associated with a restructuring involving a Type F reorganization

Structure prior to restructuring: A state-law corporation (the “Company”), operates as an S corporation for federal income tax purposes.

Step 1: The business owners form a new state-law corporation (“Holdco”).

Step 2: The stockholders of the Company contribute all of their issued and outstanding Company stock to Holdco in exchange for all of the issued and outstanding stock of Holdco. Holdco elects to treat the Company as a qualified subchapter S subsidiary by filing IRS Form 8869, Qualified Subchapter S Subsidiary Election, and checking “Yes” in box 14 regarding whether this election is being made in combination with a Section 368(a)(1)(F) reorganization. The historic S corporation subsidiary of Holdco becomes a disregarded entity for federal income tax purposes as a result of the Q-Sub election. The S corporation status of the historic S corporation is extended to Holdco per Revenue Ruling 2008-18.

Step 3: The Company is then converted into a single-member LLC through either a statutory conversion or merger into a merger sub of Holdco.

Step 4: Holdco then forms a new Delaware corporation (“Newco”) and contributes its 100% Company membership interest to Newco in exchange for Newco stock. When the dust settles, Holdco owns the stock of Newco. The Company is a wholly-owned disregarded LLC subsidiary of Newco.

If the Company is an LLC taxed as an S corporation, the steps outlined above would be adjusted to reflect the state-law entity difference. There may be additional owners of Newco added as a part of the restructuring (e.g., investors or Company employees).

The chart below illustrates the corporate organizational structure upon completion of the restructuring.