*This article was originally published in HotelExecutive on September 4, 2024

The hospitality segment of the real estate investment market is having a moment.

So called “revenge travel” was a major boost in 2022 and 2023 following the pandemic, and, while many feared the industry would slump as pent-up demand burned off, it’s still going strong through the first quarter of 2024. Both Hilton Worldwide Holdings Inc. and Wyndham Hotels & Resorts, for instance, reported growth and strategic advancement for Q1, and there are signs the momentum may continue throughout 2024 and beyond.

In its 2024 Travel Industry Outlook, Deloitte reports that Americans have come to highly prioritize travel since the pandemic. Many consumers have increased their travel budgets in recent years, and according to surveys, 1 in 5 made the increase because “spending on travel has become more important to them since the pandemic.” Deloitte also notes that the continuing prevalence of remote work helps drive the industry’s sustained prosperity.

The rising tide has lifted hospitality Real Estate Investment Trusts (REITs), among other industry participants. According to Fidelity, as of April 26 this year, hotel and resort REITs are up 19.95% over the preceding 12-month period. NAREIT recently reported that lodging and resort REITs produced the second-best total return among all REIT sectors on a year-to-date basis through the end of March.

Are REITs the Right Fit?

The future looks bright for hospitality REITs and the rest of the hospitality industry, yet, for technical reasons, REITs are an awkward fit for this industry. Hotels and resorts typically require a level of active management and customer engagement beyond that normally permitted for REITs. This article summarizes the technical issues and explains the customary workaround used by hospitality REITs.

The complication for REITs in the hospitality industry arises from a set of separate but inter-related REIT restrictions. First and foremost, REITs are generally required to generate at least 75% of their gross income from rents from real property and certain other real estate-related income, including charges for services customarily provided with the rental of real property (the 75% Income Requirement). Payments by guests to hotels are not considered “rents from real property,” and the services commonly provided by hotels to their guests are generally not customarily provided with the rental of real property. So, the income typically generated by a hotel is problematic for REITs.

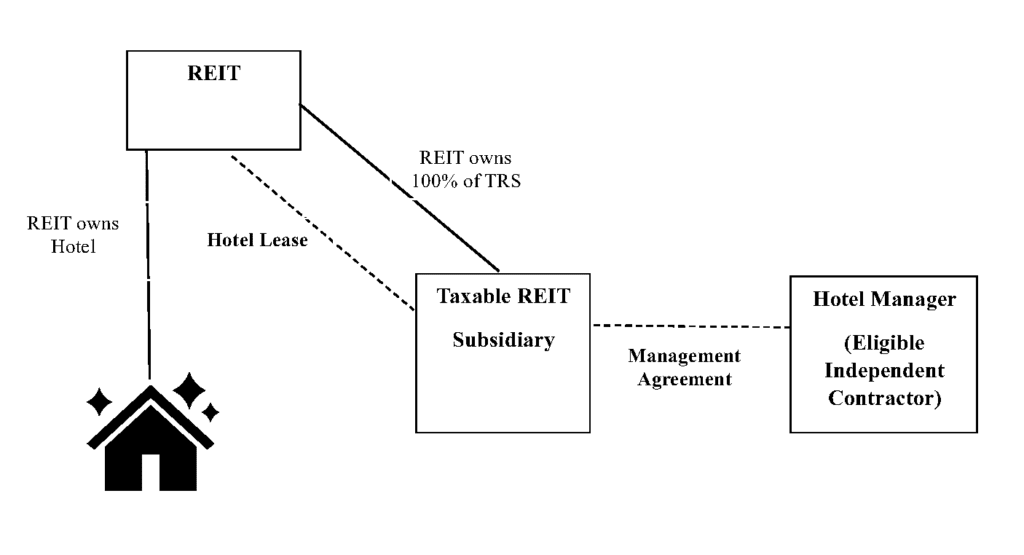

Typical hospitality REIT structure.

Addressing the Rent Income Problem

To address the issue of meeting rent income requirements, Taxable REIT subsidiaries (TRSs) are often put in place. A TRS is a corporation owned wholly or partly by a REIT, which has joined the REIT in electing TRS status. A TRS may be, and often is, controlled by its REIT stockholder – but is not required to be. The income of a TRS is subject to corporate-level tax, so, unlike REITs, TRSs are exposed to double taxation. TRSs can generally recognize certain types of income that would otherwise be problematic for REIT-compliance purposes, including hotel fees.

Hospitality REITs typically lease their hotels to TRSs, which essentially recasts the income generated by the hotels into REIT-friendly rental income paid by the TRS tenant to the REIT landlord. This arrangement is based on special provisions in the REIT rules in favor of hotels and other lodging facilities. Rental income usually does not count towards the 75% Income Requirement if it is received from a tenant that is related to the REIT, and most TRSs are related to their stockholder REITs for purposes of this rule. (A TRS is related to its REIT stockholder if the REIT owns either (a) 10% or more of the total combined voting power of all classes of voting stock of the TRS, or (b) 10% or more of the total value of shares of all classes of stock of the TRS.)

However, hospitality REITs are granted a special exception to the related-tenant restriction. The rental income received by a hospitality REIT from its TRS tenant does count toward the 75% Income Requirement, notwithstanding the related-tenant restriction, as long as the following conditions are satisfied: (1) the subject property is a “qualified lodging facility,” and (2) the property is operated on behalf of the TRS by an “eligible independent contractor.”

The term “qualified lodging facility” means a hotel, motel, or other establishment more than one-half of the dwelling units of which are used on a transient basis. The term includes customary amenities and facilities operated as part of the lodging facility, as long as the amenities and facilities are customary for other properties of a comparable size and class. Casinos are specifically excluded from the definition.

The term “eligible independent contractor” means an independent contractor that is actively engaged in the trade or business of operating qualified lodging facilities for parties other than the REIT, the TRS, and their related parties. Additionally, to qualify as “independent,” the contractor must not (a) own (directly or indirectly) more than 35% of the shares of the REIT, or (b) have more than 35% of its voting shares (nor more than 35% of the total shares of all classes) owned by someone who owns, directly or indirectly, 35% or more of the shares of the REIT. The ownership restrictions described in the preceding sentence are subject to complex attribution rules, which significantly expand the scope of the restrictions to various related parties.

Thanks to these rules, hospitality REITs generally lease their properties to TRSs, and the TRSs in turn enter into management agreements with eligible independent contractors for the management and operation of the properties. The typical arrangement is illustrated below.

In order for the arrangement to withstand IRS scrutiny, it is critical that the lease between the REIT and the TRS be properly structured and substantiated. Among the applicable requirements, the lease must constitute a true lease for federal income tax purposes and not a joint venture or management contract, and the lease payments must not depend in whole or in part on the income or profits of the TRS from the property (other than fixed percentages of receipts or sales). Properly establishing fair market rental value is especially important. If the rent is too high, the entire arrangement may fail, and if rent is too low, the TRS may unnecessarily realize significant corporate income taxes. Given the stakes, REITs often engage transfer pricing and valuation professionals to establish and substantiate fair market rental value.

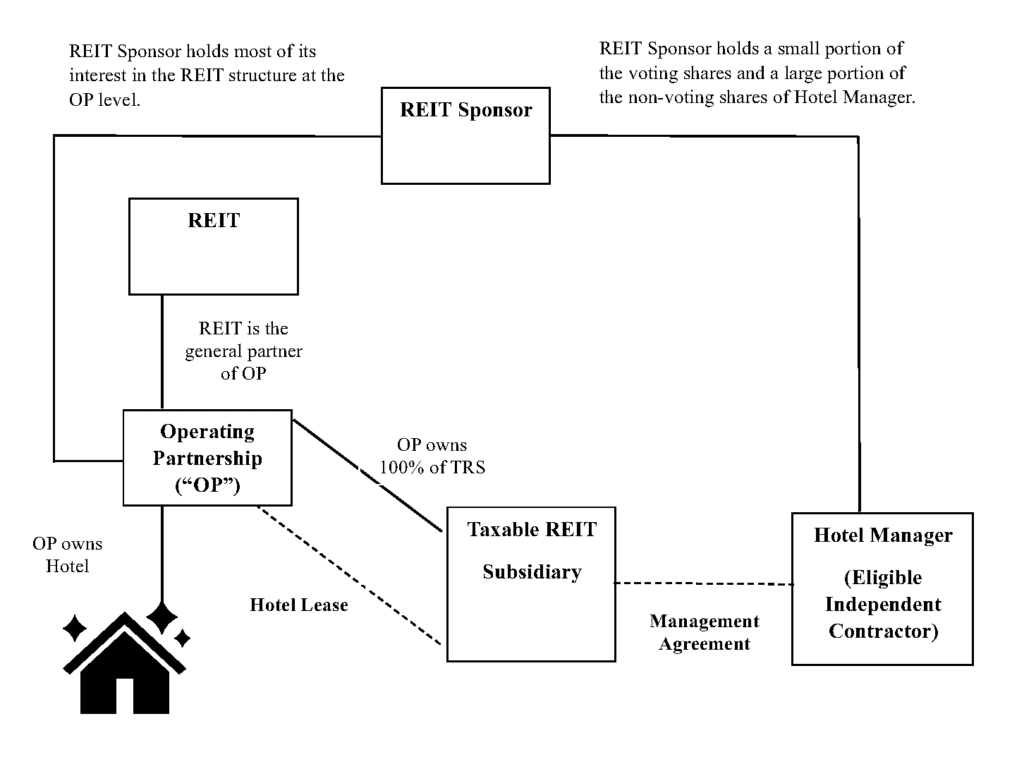

A REIT structure where a REIT sponsor owns interest in their hotel managers.

Incorporating the Hotel Manager in a REIT Structure

While the hotel manager in a hospitality REIT structure is referred to as an “eligible independent contractor,” the manager is often not entirely independent from the REIT and its sponsor. Indeed, the REIT sponsor’s experience and expertise with hospitality operations and management is often a major selling point for investors. Additional corporate structuring is necessary to enable hospitality REIT sponsors to own interests in their hotel managers without violating the REIT rules. The additional structuring generally involves two key features used in combination: (1) an operating partnership owned by the REIT, and (2) issuance of voting and non-voting classes of stock by the hotel manager.

The operating partnership feature is common across all REIT sectors. REITs often hold their properties through a limited partnership, known as an “umbrella partnership,” and the combined structure is known as an “umbrella partnership REIT” or an “UPREIT.” The REIT serves as the general partner of the umbrella partnership. Typically, the operating partnership’s primary purpose is to provide income tax benefits to investors that contribute appreciated properties rather than cash, though in the hospitality industry, operating partnerships are also used to avoid eligible independent contractor issues. The sponsor of a hospitality REIT will often hold most of its interest in the REIT’s corporate structure at the operating partnership level rather than the REIT level, thereby avoiding issues under the attribution rules discussed above.

The second feature—issuance of voting and non-voting stock by the hotel manager—is designed to take advantage of a loophole in the definition of “eligible independent contractor.” Under that definition, any person that owns 35% or more of the REIT’s shares may not also own (a) more than 35% of the voting shares of the hotel manager, or (b) more than 35% of the total shares of all classes of the hotel manager. Based on these rules, hotel managers often issue a large number of voting shares with minimal economic rights and a small number of non-voting shares with significant economic rights. The REIT sponsor typically owns few voting shares and many non-voting shares, which allows it to hold much of the hotel manager’s economics without breaching the 35% threshold. The hotel manager must be formed as a corporation in order to properly implement this feature of the hospitality REIT structure.

The hospitality industry is poised for growth and prosperity, and hospitality REITs stand to benefit greatly from its upward trajectory. However, it’s important to recognize that the formation and structuring of a hospitality REIT presents unique challenges and complications. If you are considering establishing a hospitality REIT, you should engage capable counsel experienced in the complex rules and restrictions that guide REIT operations to properly guide you through the process.

Reprinted from the Hotel Business Review with permission from www.HotelExecutive.com.