Fund Formation & Management

Reliable counsel, from start to finish

Our fund formation team, working from offices throughout Frost Brown Todd’s growing footprint, combines regional market know-how with a national focus on trends and regulatory developments shaping the private equity industry. Whether helping a first-time sponsor translate a novel investment thesis into a workable fund structure, or providing compliance advice to an established advisor managing multiple funds, we have the experience and sophistication to assist.

Our attorneys regularly advise both established funds seeking ongoing regulatory counsel and early-stage funds raising capital for the first time. We have recent practical experience advising promoters on navigating the overlapping and evolving regulatory regimes applicable to new asset classes like cryptocurrency and opportunity zones. We also work closely with more traditional funds seeking returns from early-stage venture capital investments or innovative public market strategies.

There is more interest than ever in private real estate funds. It has never been more important to make sure you have the right legal counsel to guide you through the fund process. Our real estate funds team can assist at every stage of a fund’s life cycle, from fund formation and fund marketing to the deployment of capital and winding up of assets. We represent a variety of different funds, from opportunistic funds to funds investing in specific sectors.

We take our decades of combined experience in real estate, tax and securities transactions and tailor the fund to your needs, creating a growth framework for new sponsors or helping experienced sponsors execute on their existing platforms. In each representation, at every step of the way, your investment goals are paramount, and we pride ourselves on being the type of team that can help you execute on those goals, reliably, creatively and efficiently.

Key Contacts

Partner

Louisville, KY

Partner

West Chester, OH

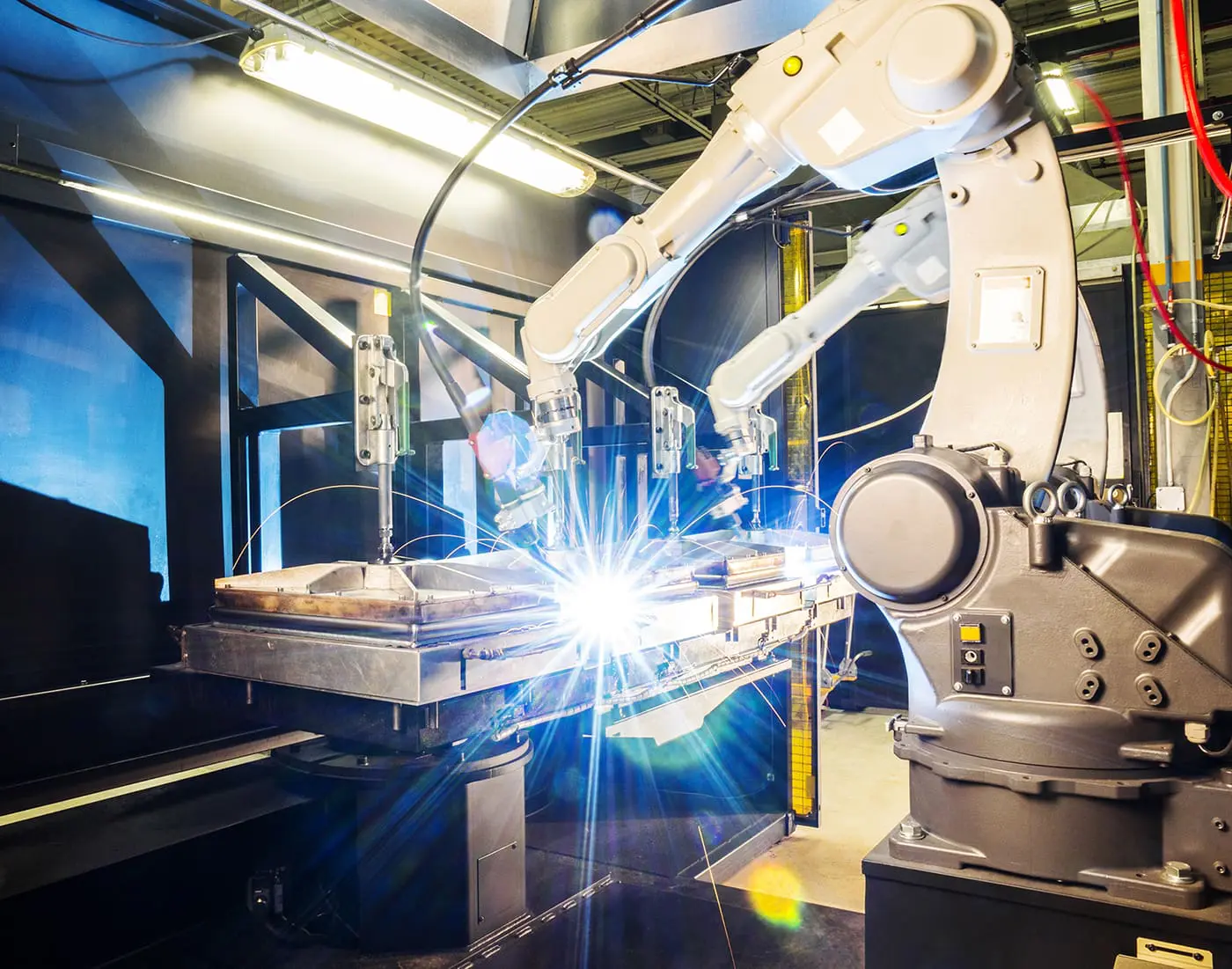

Combining local market knowledge with world-class problem solving.In addition to providing continuing counsel on the myriad of regulations applicable to fund managers, we advise on portfolio development and exit strategies. We leverage the firm’s industry-focused resources and experience in critical sectors such as health care, manufacturing, franchise and hospitality, energy, and technology to assist private equity funds in efficiently and creatively executing portfolio transactions. |

Stay ahead of the law.

Subscribe to receive email updates and choose your topics.